MergeAI Analysis

Track Merge news with AI-powered analysis and real-time market sentiment. Get breaking headlines, price movements, protocol updates, and regulatory developments—all analyzed by our AI for instant insights.

Bitcoin Treads Water At $90,000 — Market Braces For FOMC To End The Compression Phase

Bitcoin Treads Water At $90,000 — Market Braces For FOMC To End The Compression PhaseBitcoin is currently holding steady, trading water around the critical $90,000 level as the market enters a period of high compression. With ETF inflows slowing down, the price lacks the momentum to break through overhead resistance. The highly anticipated FOMC meeting is expected to provide the necessary catalyst to end the current consolidation and dictate Bitcoin’s next major directional move. BTC Compression Intensifies: Scaling Back Intraday Scalps According to a recent update from Lennaert Snyder, Bitcoin continues to tighten within a compression phase. The market has been trading in an increasingly narrow range, signaling that a larger move is approaching. Snyder noted that the scalp long and short setups from his previous analysis played out well. Related Reading: Bitcoin RSI Shows Shocking Similarities To 2012-2015, But What Happened Last Time? He explained that as compression increases, the reward-to-risk ratio naturally declines. While the trades were profitable, they still fell into the category of “C-setups,” meaning they lacked the cleaner momentum and clarity found at range boundaries. Snyder emphasized that the best trading opportunities always emerge at the edges of a range. With the current setup, his focus remains on the key resistance area around $94,000. A breakout above that level could offer long opportunities, while a failure there may open the door for shorts. On the downside, if price sweeps the lows and returns to the $87,400 support region, long entries are likely following signs of reversal. However, he added that if Bitcoin fails to show strength during this phase, he is not eager to take new long positions. A deeper retest of the $83,200 zone could become the next area of interest, though he expects any move toward that level to come with a liquidity sweep. Snyder also mentioned that he remains in shorts as a hedge, with scalp shorts still acceptable for traders who understand the increased risk at this stage. He concluded by highlighting the importance of the upcoming FOMC meeting, noting that the market is likely to stay muted until then. Upcoming FOMC Meeting Dictates Bitcoin’s Next Major Move Analyst Ted, in a recent update, revealed that BTC is currently in a state of consolidation around the $90,000 level. This tight range-bound movement suggests that while selling pressure is not dominant, buyers are also struggling to push the price higher aggressively. Related Reading: Bitcoin Market Records 21% Crash In November Trading Volume – What This Means For Price Ted attributed the market’s current stagnation and its inability to break above major resistance levels to a slowdown in institutional investment. Specifically, he noted that recent ETF inflows have slowed down, removing a major source of directional buying pressure that typically drives breakouts. Furthermore, the analyst highlighted that a critical macroeconomic event is pending: the FOMC meeting is scheduled for tomorrow, and the market’s next significant directional move will be heavily dependent on the outcome. Featured image from Pixabay, chart from Tradingview.com

Tether-Backed 'Twenty One' Completes SPAC Merger with Cantor Equity Partners

Tether-Backed 'Twenty One' Completes SPAC Merger with Cantor Equity PartnersThe newco's shares lost one-quarter of their value on the first day of trading.

Crypto Market Live: Why This FOMC Could Reset Market Expectations After a Volatile Quarter

Crypto Market Live: Why This FOMC Could Reset Market Expectations After a Volatile QuarterThe post Crypto Market Live: Why This FOMC Could Reset Market Expectations After a Volatile Quarter appeared first on Coinpedia Fintech News Tomorrow’s Federal Open Market Committee (FOMC) decision has emerged as a critical turning point for financial markets,...

Privacy Coins Emerge as 2025’s Crypto Outperformers Amidst Major Token Setbacks

Privacy Coins Emerge as 2025’s Crypto Outperformers Amidst Major Token Setbacks2025 saw Bitcoin & Ethereum erase gains, yet a privacy coin soared over 600%. Explore this market divergence, its drivers, and future implications. The post Privacy Coins Emerge as 2025’s Crypto Outperformers Amidst Major Token Setbacks appeared first on...

Bitcoin Treasury Company Twenty One Drops 25% in NYSE Debut, Trades Near PIPE Pricing of $10

Bitcoin Treasury Company Twenty One Drops 25% in NYSE Debut, Trades Near PIPE Pricing of $10The company is led by Strike CEO Jack Mallers and began trading under the XXI ticker today following its SPAC merger with Cantor Equity Partners.

Bitcoin Treasury Company Twenty One Drops 25% in NYSE Debut, Trades Near PIPE Pricing of $10

Bitcoin Treasury Company Twenty One Drops 25% in NYSE Debut, Trades Near PIPE Pricing of $10The company is led by Strike CEO Jack Mallers and began trading under the XXI ticker today following its SPAC merger with Cantor Equity Partners.

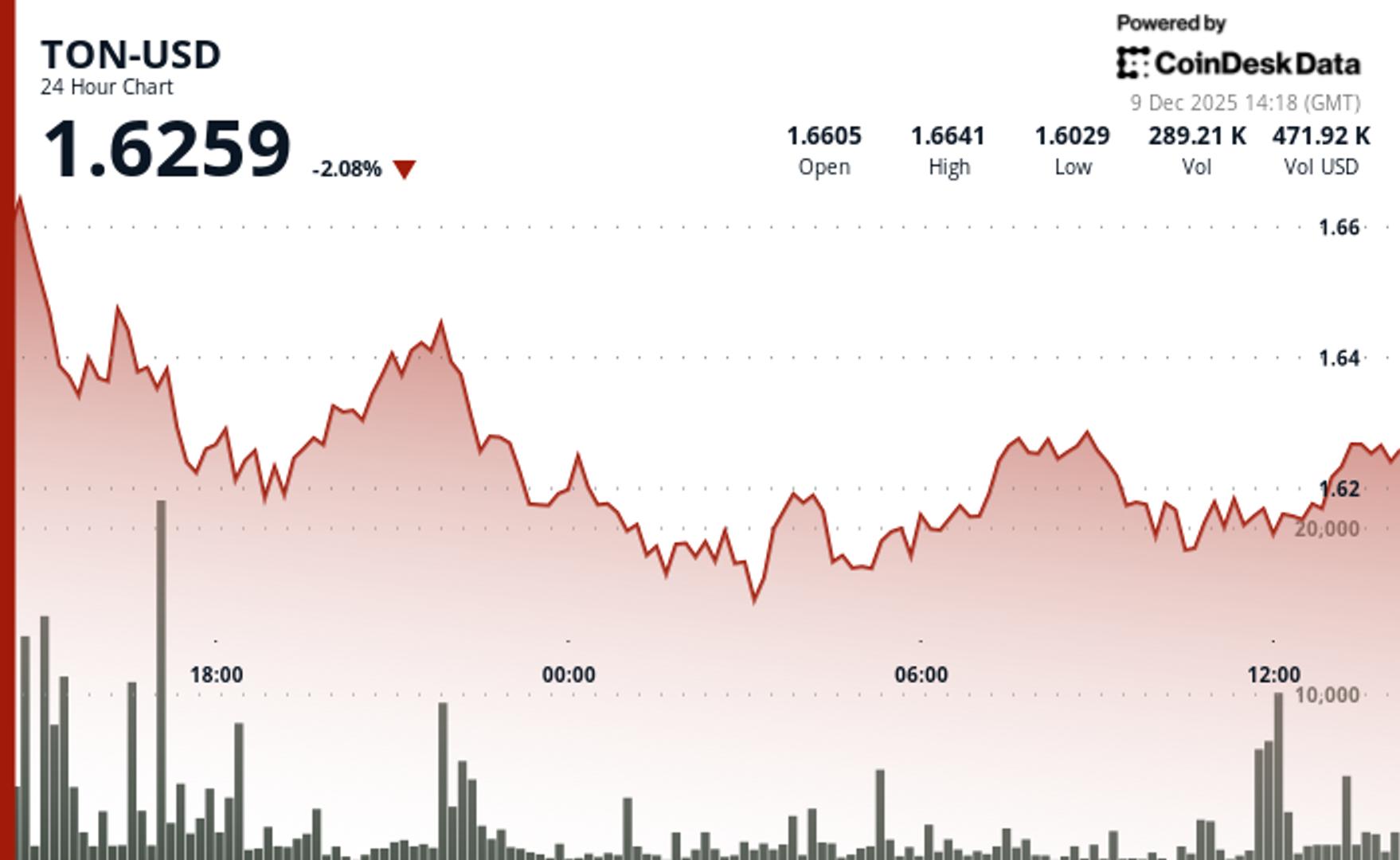

TON Token Yearly Loss Nears 72%, but Potential Reversal Signs Emerge

TON Token Yearly Loss Nears 72%, but Potential Reversal Signs EmergeThe token's price found support at $1.6025, which held firm despite initial selling pressure, and has since shown signs of a potential reversal.

XRP analysis, DOGE outlook and why Poain will capture the AI market in 2026

XRP analysis, DOGE outlook and why Poain will capture the AI market in 2026The crypto market remains volatile as BTC, XRP and other coins attempt a recovery, while AI platforms like Poain emerge as strong performers. #sponsored

Crypto nears its ‘Netscape moment’ as industry approaches inflection point

Crypto nears its ‘Netscape moment’ as industry approaches inflection pointCrypto is at a mainstream tipping point due to the emergence of regulated investment products, according to Matt Huang of Paradigm.

Crypto nears its ‘Netscape moment’ as industry approaches inflection point

Crypto nears its ‘Netscape moment’ as industry approaches inflection pointCrypto is at a mainstream tipping point due to the emergence of regulated investment products, according to Matt Huang of Paradigm.

Binance Charity Donates $200,000 to Thai Red Cross for Flood Relief

Binance Charity Donates $200,000 to Thai Red Cross for Flood ReliefBinance Charity has donated USD 200,000 to the Thai Red Cross Society to support flood relief efforts in Southern Thailand. The funds will provide emergency supplies and aid long-term recovery, with a focus on transparency and efficiency through blockchain...

![Monero [XMR] rebounds from $360, but $380 barrier emerges: What next?](https://ambcrypto.com/wp-content/uploads/2025/12/Monero-Featured-1.webp) Monero [XMR] rebounds from $360, but $380 barrier emerges: What next?

Monero [XMR] rebounds from $360, but $380 barrier emerges: What next?The liquidation levels at and above $385 are likely to pull Monero prices higher in the coming days.

SOL Price Prediction: Targeting $145-150 Within 7 Days as Technical Momentum Builds

SOL Price Prediction: Targeting $145-150 Within 7 Days as Technical Momentum BuildsSOL price prediction points to $145-150 target by mid-December as MACD bullish divergence emerges despite recent 4.59% decline, with critical $127 support holding firm. (Read More)

HYPE Jumps 8% After $888 Million DAT Gets Approved

HYPE Jumps 8% After $888 Million DAT Gets ApprovedSonnet BioTherapeutics will merge with Rorschach LLC to launch the first major HYPE treasury company.