BtcAI Analysis

Track Btc news with AI-powered analysis and real-time market sentiment. Get breaking headlines, price movements, protocol updates, and regulatory developments—all analyzed by our AI for instant insights.

- NEW

Bitcoin In An Opportunity Zone? Hash Ribbons Flash New Buy Signal

Bitcoin In An Opportunity Zone? Hash Ribbons Flash New Buy SignalOn-chain data shows the popular Bitcoin Hash Ribbons indicator has just given a miner capitulation signal. Here’s what this could mean. Bitcoin Hash Ribbons Now Signaling Miner Stress As pointed out by CryptoQuant author Darkfrost in an X post, the Bitcoin Hash Ribbons have shown a crossover that has historically corresponded to rising stress among the miners. The Hash Ribbons indicator aims to gauge the situation of the miners by comparing the 30-day and 60-day moving averages (MAs) of the BTC Hashrate, a metric that measures the total amount of computing power that the validators as a whole have connected to the blockchain. Related Reading: Bitcoin Speculation Muted: Glassnode Analyst Calls Perps A ‘Ghost Town’ The trend in the Hashrate can act as a representation of the sentiment among the miners, as they usually expand computing power (an increase in the Hashrate) when mining is profitable and/or they believe BTC is heading toward a bullish outcome, while they decommission mining rigs (a drop in the Hashrate) when they are having a hard time breaking even. The Hash Ribbons indicator basically captures shifts between these two behaviors. When the 30-day ribbon falls below the 60-day one, it means miners are reducing power at a fast rate. This can be a sign that this group is going through capitulation. Such a crossover has recently formed again for Bitcoin, as the chart below shared by Darkfrost shows. Thus, it would appear that miners are once again in a phase of capitulation. “Historically, these periods of mining stress have been profitable for Bitcoin investors, with one exception during the 2021 mining ban in China,” noted the analyst. The signal doesn’t act as a straightforward buy indicator, however, as mining capitulation often doesn’t directly coincide with a bottom. “In the short term, these periods tend to be bearish because miners may need to increase their selling to cover production costs,” explained Darkfrost. In general, miner capitulation periods have tended to lead into profitable buying windows for the cryptocurrency, although it’s unpredictable how long such a phase would last. From the chart, it’s apparent that sometimes the Hash Ribbons signal has been quite brief, while other times it has been maintained for weeks. As for what has forced miners to turn off Hashrate recently, the answer likely lies in the bearish trajectory that Bitcoin has witnessed. Miners obtain their reward in BTC denomination, so how the USD value of the coin fluctuates directly affects their dollar revenue. Related Reading: XRP Selloff: Whales Shed Coins Worth $1 Billion In A Week Before this, miners had been in a phase of rapid expansion alongside the bull rally, which had led to an explosion in the network’s mining Difficulty. With the price plummeting and Difficulty being at extraordinary levels, miners have faced a double whammy during the past month. BTC Price Bitcoin saw a recovery above $92,000 on Monday, but it would appear that the asset wasn’t able to maintain it, as its price is now back at $90,300. Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com

- NEW

Jack Mallers’ Twenty One Capital Vows to Buy ‘As Much Bitcoin as Possible’

Jack Mallers’ Twenty One Capital Vows to Buy ‘As Much Bitcoin as Possible’Bitcoin Magazine Jack Mallers’ Twenty One Capital Vows to Buy ‘As Much Bitcoin as Possible’ Jack Mallers’ Twenty One Capital launched on the NYSE as he pledged to buy as much Bitcoin as possible. This post Jack Mallers’ Twenty One Capital Vows to Buy ‘As Much Bitcoin as Possible’ first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

- NEW

Ether Surges 8%, Outpacing Bitcoin Gains Amid Staking ETF, Tokenization Optimism

Ether Surges 8%, Outpacing Bitcoin Gains Amid Staking ETF, Tokenization OptimismBlackRock's filing for a staking ether ETF earlier this week has contributed to ETH's relative strength to bitcoin, one market strategist noted.

- NEW

Crypto Market Consolidates as Funds Rotate to BTC and ETH After $2B Liquidations: Wintermute

Crypto Market Consolidates as Funds Rotate to BTC and ETH After $2B Liquidations: WintermuteThe crypto market has entered a range-bound consolidation, with Bitcoin near $92,000 and value at $3.25 trillion, as Wintermute research notes resilient majors, muted leverage, and positioning shaped by looming Fed and BOJ policy decisions into year-end. The post Crypto Market Consolidates as Funds Rotate to BTC and ETH After $2B Liquidations: Wintermute appeared first on Cryptonews.

- NEW

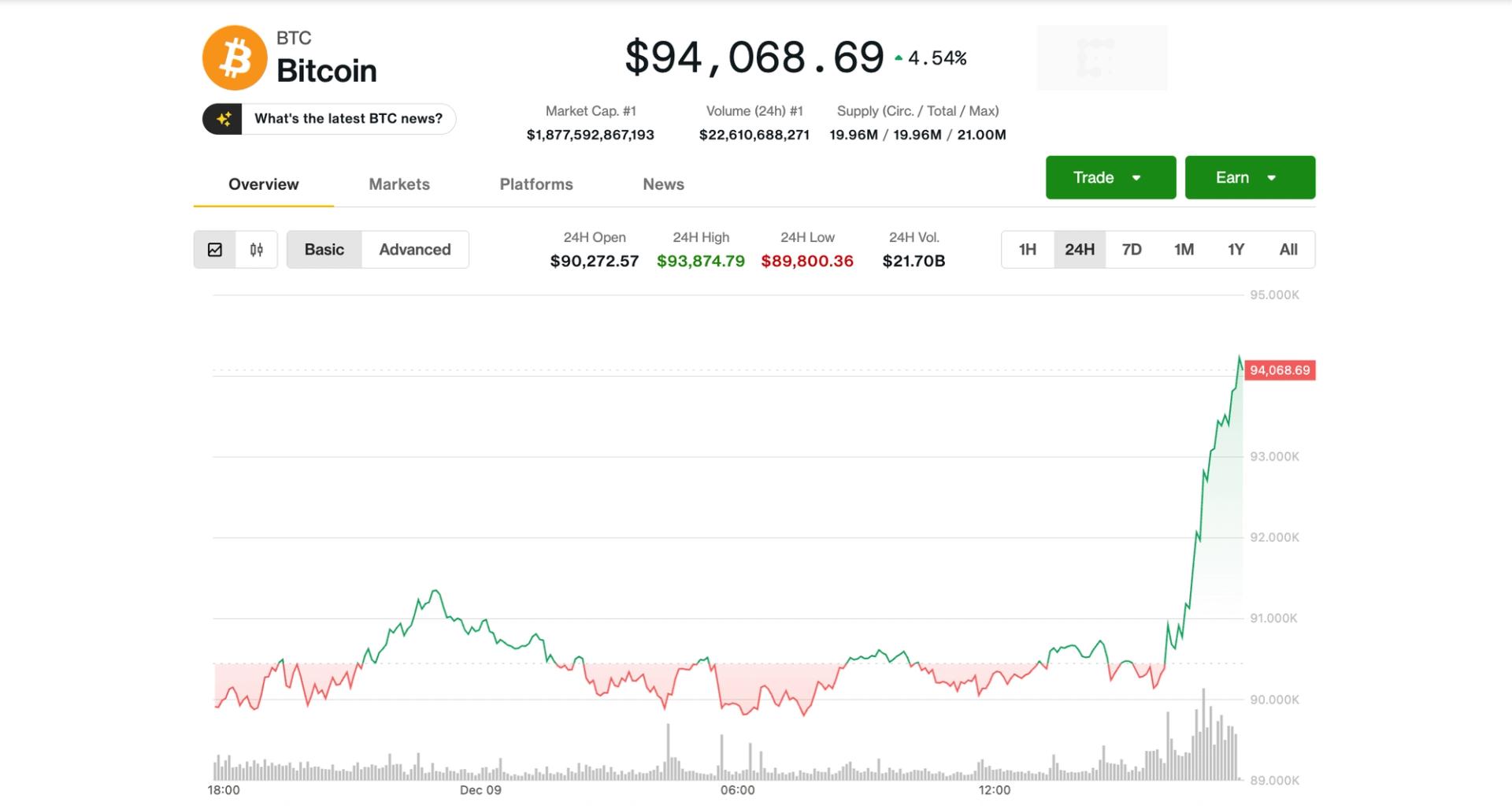

Bitcoin’s back above $94K: Is the BTC bull run back on?

Bitcoin’s back above $94K: Is the BTC bull run back on?Bitcoin bulls recaptured the $94,000 level, but BTC volume data raises doubts about the duration of the upmove. Will bulls provide the necessary momentum?

- NEWAndrew Tate’s Bitcoin Post Sparks MicroStrategy Debate

Andrew Tate’s post questioning why MicroStrategy’s 10,000 BTC purchase did not move Bitcoin’s price has triggered a heated debate across the crypto community. Analysts point to OTC execution, market depth, and unseen liquidity flows as key reasons large buys remain invisible on charts despite their scale. The post Andrew Tate’s Bitcoin Post Sparks MicroStrategy Debate appeared first on BeInCrypto.

- NEW

New Bitcoin ETF Bets on Nighttime Trading

New Bitcoin ETF Bets on Nighttime TradingThis new product is one of the more unconventional innovations in the burgeoning crypto ETF space.

- NEW

On the value of holding the History of Bitcoin in your hands

On the value of holding the History of Bitcoin in your handsBitcoin Magazine On the value of holding the History of Bitcoin in your hands In Bitcoin culture, there is still a noticeable gap between the importance of the subject and the forms in which it is presented. Much of what exists is entirely digital, quick to disappear, or shaped by a purely functional aesthetic. Even projects that engage with Bitcoin’s history or its artistic dimension often end up looking […] This post On the value of holding the History of Bitcoin in your hands first appeared on Bitcoin Magazine and is written by Steven Reiss.

- NEW

China’s $71 billion Treasury dump exposes a critical gap between Bitcoin’s narrative and central bank reality

China’s $71 billion Treasury dump exposes a critical gap between Bitcoin’s narrative and central bank realityThe BRICS bloc now counts 11 members, and several of the largest holders have trimmed their US Treasury positions over the past year. China cut its stake by $71.5 billion between September 2024 and September 2025, dropping from $772 billion to $700.5 billion. India reduced holdings by $44.5 billion, Brazil by $61.9 billion, and Saudi […] The post China’s $71 billion Treasury dump exposes a critical gap between Bitcoin’s narrative and central bank reality appeared first on CryptoSlate.

- NEW

PNC Bank launches Bitcoin trading for eligible clients via Coinbase integration

PNC Bank launches Bitcoin trading for eligible clients via Coinbase integrationThe move makes PNC the first major US bank to offer spot Bitcoin trading within its own digital platform, starting with private bank clients.

Crypto Market Rallies Ahead of Fed Meeting

Crypto Market Rallies Ahead of Fed MeetingBitcoin and Ethereum surged amid anticipation that the US central bank will cut rates tomorrow.

Why The Litecoin Price Could Stage A 33% Rally To $110

Why The Litecoin Price Could Stage A 33% Rally To $110A crypto analyst has forecasted that the Litecoin price is gearing up for an explosive rally to $110. Unlike Bitcoin and Ethereum, which have seen considerable declines over the past few months, Litecoin appears to be stabilizing, gaining about 7.8% this past week, according to CoinMarketCap. Although LTC has seen its fair share of declines this year, analysts still hold hope that the cryptocurrency could cross the $100 threshold and reclaim former highs. Litecoin Price Targets A $110 Breakout Litecoin may be preparing for a strong upward move, according to a new analysis from TradingView market expert MadWhale. The analyst has indicated that the cryptocurrency has the technical structure needed to break out of its long-term descending channel and potentially climb toward $110. With its current price sitting around $83, a surge to this level would represent a significant 33% rally. Related Reading: Litecoin 2M Bollinger Band Width Hits New Lows, CMT-Certified Analyst Reveals What It Means MadWhale has based his bullish LTC forecast on weekly candlesticks and how the cryptocurrency has consistently responded to past support and resistance levels. He explained that the altcoin had been trapped in a descending channel that has controlled its price for several weeks now. According to the TradingView analyst, Litecoin is now approaching the upper resistance region of the descending channel–a point where traders usually watch for either a clean breakout or a sharp rejection. From the analyst’s price chart, Litecoin’s support zones have repeatedly held firm, showing that buyers consistently defended the area. Due to this steady support, he expects Litecoin’s bounce near the descending channel’s upper resistance to build momentum. If the support holds, MadWhale suggests the cryptocurrency could skyrocket to $110, completing its breakout from the descending channel. A breakout could signal a significant shift, potentially transforming Litecoin’s recent downtrend into a new bullish phase. MadWhale’s chart also highlights the cryptocurrency’s volatility, showing that in early October, LTC had rallied around 33.84%, climbing above $120. However, just days later, it crashed more than 17%, coinciding with the October 10 liquidation event that shook the market. Update On LTC’s Price Action Litecoin is approximately 79% below its all-time high of over $410, recorded during the 2021 bull run. The cryptocurrency has dropped 17.68% over the past week and is down 33% for the year, mirroring the broader decline seen across altcoins. Despite its performance, LTC’s Fear and Greed Index remains in the neutral zone, suggesting that crypto investors are cautiously optimistic. Related Reading: Analyst Reveals How Litecoin Can Turn $3,700 Into $1 Million For Investors According to market analyst CW on X, the next sell wall for Litecoin is at $98, about 15% above its current price. Once the cryptocurrency reaches this level, CW expects a significant number of sellers to offload their coins. His chart also highlights the next key resistance levels for LTC, suggesting a potential surge to $98 first and then to the $106-$110 range. Featured image from Adobe Stock, chart from Tradingview.com

Bitcoin Price Prediction: BlackRock Doubles Down on Crypto with New ETF Filing – Is a Full-Scale Wall Street Invasion About to Begin?

Bitcoin Price Prediction: BlackRock Doubles Down on Crypto with New ETF Filing – Is a Full-Scale Wall Street Invasion About to Begin?BlackRock's SEC filing for a staked Ethereum ETF represents a strategic shift toward yield-bearing crypto products, coming as the firm's Bitcoin ETF commands $70 billion in assets and sovereign funds quietly accumulate BTC despite technical weakness near $92,000. The post Bitcoin Price Prediction: BlackRock Doubles Down on Crypto with New ETF Filing – Is a Full-Scale Wall Street Invasion About to Begin? appeared first on Cryptonews.

Bitcoin Price Soars to $94K on Escalating Odds of Another Rate Cut

Bitcoin Price Soars to $94K on Escalating Odds of Another Rate CutBitcoin taps $94K as odds of a rate cut tomorrow reach 96%

Bitcoin Price Skyrockets to $94,000 as Banks Start to Embrace Bitcoin

Bitcoin Price Skyrockets to $94,000 as Banks Start to Embrace BitcoinBitcoin Magazine Bitcoin Price Skyrockets to $94,000 as Banks Start to Embrace Bitcoin The bitcoin price is pumping this morning, currently trading above $94,000. This post Bitcoin Price Skyrockets to $94,000 as Banks Start to Embrace Bitcoin first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Ripple Gets $500 Million From Wall Street, Strategy Makes Biggest Bitcoin (BTC) Purchase in Months, Shiba Inu (SHIB) Eyes Big Price Move – Crypto News Digest

Ripple Gets $500 Million From Wall Street, Strategy Makes Biggest Bitcoin (BTC) Purchase in Months, Shiba Inu (SHIB) Eyes Big Price Move – Crypto News DigestCrypto market today: Wall Street moves $500 million into Ripple; Strategy has purchased nearly $1 billion worth of BTC; 45 billion SHIB leave exchanges.

- Bitcoin Breaks Above $94,000 After Week-Long Stagnation, Here’s Why

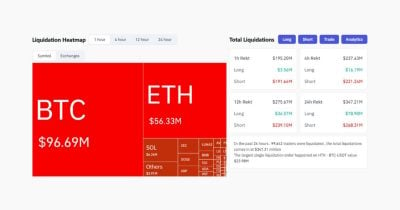

Bitcoin has snapped out of a week-long stagnation, breaking above $94,000 after holding between $88K–$92K for days. Whale accumulation, forced liquidations, shifting regulatory tone, and rate-cut expectations appear to have triggered the move as markets brace for the FOMC decision. The post Bitcoin Breaks Above $94,000 After Week-Long Stagnation, Here’s Why appeared first on BeInCrypto.

Crypto Shorts Get Rekt as Bitcoin, Ethereum and XRP Spike Ahead of Fed Decision

Crypto Shorts Get Rekt as Bitcoin, Ethereum and XRP Spike Ahead of Fed DecisionBitcoin is surging towards $95,000 on Tuesday ahead of the Fed's interest rate decision, hitting its highest price since mid-November.

Baltex Launches BTC to XMR Private Swaps

Baltex Launches BTC to XMR Private SwapsJacó, Costa Rica, 9th December 2025, Chainwire

Michael Saylor Urges Middle East to Become the 'Switzerland of Bitcoin Banking'

Michael Saylor Urges Middle East to Become the 'Switzerland of Bitcoin Banking'The executive chairman of Strategy pitched BTC-backed banking and yield products as a $200 trillion opportunity at the Bitcoin MENA conference.

Popular Crypto Analyst Reveals New Bitcoin Price Target That Has Got The Community Moving

Popular Crypto Analyst Reveals New Bitcoin Price Target That Has Got The Community MovingRenowned analyst Peter Brandt has unveiled a new set of Bitcoin price targets that have quickly sparked discussion across trading communities. His updated technical roadmap comes as BTC shows signs of cooling, prompting traders to reassess its recent price movement. With Bitcoin slipping beneath the structure that supported its multi-month climb, Brandt’s projected corrective zones […]

Wall Street Giant Bernstein Predicts Bitcoin Price To Hit $1 Million By 2033

Wall Street Giant Bernstein Predicts Bitcoin Price To Hit $1 Million By 2033Wall Street research firm Bernstein has reiterated one of the boldest long-term calls in traditional finance, confirming a $1 million Bitcoin price target for 2033 while materially revising how and when it expects the market to get there. Bernstein Keeps $1 Million Price Target For Bitcoin The latest shift surfaced after Matthew Sigel, head of digital assets research at VanEck, shared an excerpt from a new Bernstein note on X. In it, the analysts write: “In view of recent market correction, we believe, the Bitcoin cycle has broken the 4-year pattern (cycle peaking every 4 years) and is now in an elongated bull-cycle with more sticky institutional buying offsetting any retail panic selling.” The analyst from Bernstein added: “Despite a ~30% Bitcoin correction, we have seen less than 5% outflows via ETFs. We are moving our 2026E Bitcoin price target to $150,000, with the cycle potentially peaking in 2027E at $200,000. Our long term 2033E Bitcoin price target remains ~$1,000,000.” Related Reading: Did 2025 Mark A Bear Market For Bitcoin? Predictions Point To A $150,000 Rally In 2026 This marks a clear evolution from Bernstein’s earlier cycle roadmap. In mid-2024, when the firm first laid out the $1 million-by-2033 thesis as part of its initiation on MicroStrategy, it projected a “cycle-high” of around $200,000 by 2025, up from an already-optimistic $150,000 target, explicitly driven by strong US spot ETF inflows and constrained supply. Subsequent commentary reiterated that path and framed Bitcoin firmly within the traditional four-year halving rhythm: ETF demand would supercharge, but not fundamentally alter, the classic post-halving boom-and-bust pattern. Reality forced an adjustment. Bitcoin did break to new highs on the back of ETF demand, validating Bernstein’s structural call that regulated spot products would be a decisive catalyst. However, price action has fallen short of the earlier timing: the market topped out in the mid-$120,000s rather than the $200,000 band originally envisaged for 2025, and a roughly 30% drawdown followed. Related Reading: Bitcoin To Hit $50 Million By 2041, Says EMJ Capital CEO What changed is not the end-state, but the path. Bernstein now argues that the four-year template has been superseded by a longer, ETF-anchored bull cycle. The critical datapoint underpinning this view is behavior in the recent correction: despite a near one-third price decline, spot Bitcoin ETFs have seen only about 5% net outflows, which the firm interprets as evidence of “sticky” institutional capital rather than the reflexive retail capitulation that defined previous tops. In the new framework, earlier targets are effectively rescheduled rather than abandoned. The mid-2020s six-figure region is shifted out by roughly one to two years, with $150,000 now penciled in for 2026 and a potential cycle peak near $200,000 in 2027, while the 2033 $1 million objective is left unchanged. In that sense, Bernstein’s track record is mixed but internally consistent. The firm has been directionally right on the drivers—ETF adoption, institutionalization, and supply absorption—but too aggressive on the speed at which those forces would translate into price. The latest note formalizes that recognition: same destination, slower ascent, and a Bitcoin market that Bernstein now sees as governed less by halvings and more by the behavior of large, ETF-mediated capital pools over the rest of the decade. At press time, BTC traded at $90,319. Featured image created with DALL.E, chart from TradingView.com

Crypto Traders Turn Cautious, Favor Bitcoin Over Risky Altcoin Bets

Crypto Traders Turn Cautious, Favor Bitcoin Over Risky Altcoin BetsBitcoin has rebounded to around $92,000 as crypto markets have absorbed a $2B liquidation shock, but ETF outflows, softer realised capital inflows and elevated volatility show traders have favored delta-neutral yield strategies ahead of Fed and BOJ decisions over fresh altcoin exposure. The post Crypto Traders Turn Cautious, Favor Bitcoin Over Risky Altcoin Bets appeared first on Cryptonews.

Bitcoin reclaims $94K ahead of tomorrow’s Fed meeting

Bitcoin reclaims $94K ahead of tomorrow’s Fed meetingBitcoin climbed past $94K as markets priced in a Fed rate cut for tomorrows meeting, lifting the broader crypto market. The post Bitcoin reclaims $94K ahead of tomorrow’s Fed meeting appeared first on Crypto Briefing.

Bitcoin Surges to $94K One Day Ahead of Expected Fed Rate Cut

Bitcoin Surges to $94K One Day Ahead of Expected Fed Rate CutThe change from what's become typical bearish U.S. session action could signal seller exhaustion.

Over $190M in crypto shorts liquidated in last hour amid Bitcoin rally

Over $190M in crypto shorts liquidated in last hour amid Bitcoin rallyThe surge in Bitcoin's price highlights the risks of leveraged trading, potentially leading to increased market volatility and cascading liquidations. The post Over $190M in crypto shorts liquidated in last hour amid Bitcoin rally appeared first on Crypto Briefing.

‘We are going to buy all of it’: Michael Saylor talks Bitcoin Strategy at Bitcoin MENA Conference

‘We are going to buy all of it’: Michael Saylor talks Bitcoin Strategy at Bitcoin MENA ConferenceBitcoin Magazine ‘We are going to buy all of it’: Michael Saylor talks Bitcoin Strategy at Bitcoin MENA Conference Speaking at Bitcoin MENA, Michael Saylor framed Bitcoin as the foundation of a new era in digital capital and credit. This post ‘We are going to buy all of it’: Michael Saylor talks Bitcoin Strategy at Bitcoin MENA Conference first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

BTC остановился на уровне $90 000, ФРС подает мягкие сигналы

BTC остановился на уровне $90 000, ФРС подает мягкие сигналыБиткoин снова в центре внимания: после стремительного роста первая криптовалюта закрепилась около отметки $90 000, а мягкая риторика ФРС снижает давление на рисковые активы. Для долгосрочных держателей это редкий момент, когда макроэкономический фон и крипторынок наконец начинают играть в одну сторону. Важная деталь: при такой цене биткоин остается в основном «цифровым золотом». Он отлично хранит […]

Bitcoin’s new “self-bribe” code lets you build sobriety wallets that pay your enemies if you break a promise

Bitcoin’s new “self-bribe” code lets you build sobriety wallets that pay your enemies if you break a promiseWhen the ball drops this New Year’s Eve, you could look to Bitcoin to help you keep your New Year’s resolutions. Bitcoin can enforce promises with code and collateral. That unlocks a class of “self-bribes,” in which a person escrows funds today under conditions only future behavior can satisfy, with payout paths encoded in script […] The post Bitcoin’s new “self-bribe” code lets you build sobriety wallets that pay your enemies if you break a promise appeared first on CryptoSlate.

Crypto Rally Stalls Near $94K Bitcoin as Bond Turmoil Spurs Risk-Off Ahead of Fed

Crypto Rally Stalls Near $94K Bitcoin as Bond Turmoil Spurs Risk-Off Ahead of FedCrypto has begun December with a rally driven by large Bitcoin purchases and the Fusaka upgrade before fading, as Gracy Chen and Laser Digital point to rising bond yields, expectations for a Fed rate cut, BOJ risks and options pricing that has flagged choppy trading into year-end. The post Crypto Rally Stalls Near $94K Bitcoin as Bond Turmoil Spurs Risk-Off Ahead of Fed appeared first on Cryptonews.

Is Fleet Mining the Best Green Cloud Mining Platform? Become a BTC, ETH, and SOL User and Grow Stable Daily Income

Is Fleet Mining the Best Green Cloud Mining Platform? Become a BTC, ETH, and SOL User and Grow Stable Daily IncomeWhile the Bitcoin (BTC) market is unstable, the massive computing network behind one of the largest blockchains in the world is continuously breaking records. It’s worth noting that cloud mining platform Fleet Mining announced today that all new users will receive a $15–$100 bonus, allowing them to start Bitcoin mining immediately for free with no entry threshold. With cloud […]

Bitcoin and XRP Secure Fresh NYSE Exposure Through Bitwise Index Move

Bitcoin and XRP Secure Fresh NYSE Exposure Through Bitwise Index MoveBitcoin and XRP expanded their Wall Street footprint as part of Bitwise's index listing on NYSE Arca amid $935 million ETF inflows.

Binance Founder CZ Says the 4-Year Bitcoin Cycle Is Over — Predicts a Potential Bitcoin Supercycle

Binance Founder CZ Says the 4-Year Bitcoin Cycle Is Over — Predicts a Potential Bitcoin SupercycleBitcoin Magazine Binance Founder CZ Says the 4-Year Bitcoin Cycle Is Over — Predicts a Potential Bitcoin Supercycle At the Bitcoin MENA conference, Binance’s CZ discussed Bitcoin’s booming role in global finance. This post Binance Founder CZ Says the 4-Year Bitcoin Cycle Is Over — Predicts a Potential Bitcoin Supercycle first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Stalls Near $90K as Select Altcoins Rally, Leaving ‘Altcoin Season’ on Hold

Bitcoin Stalls Near $90K as Select Altcoins Rally, Leaving ‘Altcoin Season’ on HoldAltcoin sentiment has stayed cautious as fear readings sit near 25 and Bitcoin has traded just above $90,000, while Zcash, MemeCore and Cardano have posted modest gains that reflect selective interest rather than a broad return of risk appetite. The post Bitcoin Stalls Near $90K as Select Altcoins Rally, Leaving ‘Altcoin Season’ on Hold appeared first on Cryptonews.

Bitcoin (BTC) Price Analysis for December 9

Bitcoin (BTC) Price Analysis for December 9Can Bitcoin (BTC) continue rising to the $95,000 area?.

Coinbase Partners With US Bank to Boost Bitcoin Adoption

Coinbase Partners With US Bank to Boost Bitcoin AdoptionCoinbase signs partnership with major US bank as crypto adoption continues to grow across the global market.

Shiba Inu’s Volume Explosion: Leading Meme Coin Barrels Ahead In This Metric

Shiba Inu’s Volume Explosion: Leading Meme Coin Barrels Ahead In This MetricShiba Inu has recorded a notable surge in spot trading activity on several exchanges over the last seven days. This provides a bullish outlook for the second-largest meme coin by market cap, which has been one of the underperformers in this market cycle. Shiba Inu Sees Surge In Spot Trading Activity CoinGlass data show a 154% surge in Shiba Inu USD spot trading volume on Kraken over the last seven days. There has also been a significant surge on other major exchanges, such as Binance, Bybit, OKX, and Gemini, during the same period. This indicates that spot buyers may be stepping in to defend the SHIB price at a critical support amid the broader crypto market decline. Related Reading: Will A Shiba Inu ETF Follow After Dogecoin? The Lone SHIB Filing Standing Against The Crowd Notably, Shiba Inu is one of the altcoins that are in the green over the last week, suggesting that the bulls may be in control at the moment. CoinMarketCap data shows that the second-largest meme coin by market cap is up almost 7% during this period despite Bitcoin’s choppy price action. Meanwhile, further data from CoinGlass also shows that most leverage traders are currently betting on an increase in the Shiba Inu price, with the long/short ratio currently above 1. However, it is worth noting that derivatives volume is down by over 10% and open interest is down by almost 4%, which presents a bearish outlook for the meme coin. Another positive for Shiba Inu, besides the surge in spot trading volume, is that the Fed is likely to cut interest rates again at this week’s FOMC meeting. This could inject more liquidity into the crypto market, with altcoins like SHIB benefiting from it. Meanwhile, Bitcoin is currently looking to hold above the psychological $90,000 level, which could pave the way for higher prices for SHIB given their positive correlation. Community Gives Update On SHIB’s Progress In an X post, Shiba Inu community member Shibizens gave an update on SHIB’s progress over the last few days. The community member noted that over 45 billion SHIB have been moved off exchanges, indicating that holders are accumulating. Shibizens also alluded to a $35 million whale transfer into a private wallet, suggesting that SHIB whales are also bullish. Related Reading: Will The Shiba Inu Price Hit A New All-Time High In 2025? Machine Learning Algorithm Answers Furthermore, Coinbase is set to launch Shiba Inu futures on December 12 for institutional and retail investors, which could boost the meme coin’s adoption. Meanwhile, NYSE Arca has filed the 19b-4 for T. Rowe’s Shiba Inu ETF, bringing the ETF one step closer to launch. Shibuzens also highlighted upgrades on the Shibarium network, which could provide a major boost for SHIB. This includes the RPC upgrade, while a full privacy upgrade has been confirmed using encrypted tech. There are plans to roll this out by next year. At the time of writing, the Shiba Inu price is trading at around $0.000008498, up in the last 24 hours, according to data from CoinMarketCap. Featured image from Peakpx, chart from Tradingview.com

PNC Becomes First Major U.S. Bank to Offer Direct Bitcoin Trading to Clients via Coinbase

PNC Becomes First Major U.S. Bank to Offer Direct Bitcoin Trading to Clients via CoinbaseBitcoin Magazine PNC Becomes First Major U.S. Bank to Offer Direct Bitcoin Trading to Clients via Coinbase PNC Bank is now the first major U.S. bank to offer eligible Private Bank clients direct bitcoin trading through its platform, powered by Coinbase’s infrastructure. This post PNC Becomes First Major U.S. Bank to Offer Direct Bitcoin Trading to Clients via Coinbase first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin edges near ETF average cost as inflows slow and price consolidates

Bitcoin edges near ETF average cost as inflows slow and price consolidatesBitcoin is trading close to the average entry price of U.S. spot ETFs, while daily inflows temporarily turn negative.

Big Bitcoin Move: Galaxy Digital Sends 900 BTC To New Address

Big Bitcoin Move: Galaxy Digital Sends 900 BTC To New AddressGalaxy Digital, a major crypto services firm, transferred 900 BTC to a wallet that was created shortly before the move on December 9, 2025, according to on-chain monitoring shared by blockchain analysts. Related Reading: Bitcoin Back In Argentina: Central Bank Removes 3-Year Restrictions The coins were valued at close to $81.60 million at the time […]

PNC Bank Enables Bitcoin Trading for Customers via Coinbase

PNC Bank Enables Bitcoin Trading for Customers via CoinbasePNC Bank debuted a service allowing some customers to trade Bitcoin on its banking platform, broadening access through Coinbase.

Bitcoin Treasury Company Twenty One Drops 25% in NYSE Debut, Trades Near PIPE Pricing of $10

Bitcoin Treasury Company Twenty One Drops 25% in NYSE Debut, Trades Near PIPE Pricing of $10The company is led by Strike CEO Jack Mallers and began trading under the XXI ticker today following its SPAC merger with Cantor Equity Partners.

Santiment reports over 403,000 Bitcoin moved off exchanges in the past year

Santiment reports over 403,000 Bitcoin moved off exchanges in the past yearThe significant Bitcoin withdrawal from exchanges suggests increased investor confidence, potentially stabilizing prices and reducing sell-off risks. The post Santiment reports over 403,000 Bitcoin moved off exchanges in the past year appeared first on Crypto Briefing.

Bitcoin Hash Ribbons flash ‘buy’ signal at $90K: Will BTC price rebound?

Bitcoin Hash Ribbons flash ‘buy’ signal at $90K: Will BTC price rebound?Bitcoin miners offer a glimpse into potential BTC price upside to come as the historically accurate Hash Ribbons sent a buy signal.

Bitwise 10 Crypto Index ETF debuts on NYSE Arca with BTC, ETH, and XRP exposure

Bitwise 10 Crypto Index ETF debuts on NYSE Arca with BTC, ETH, and XRP exposureBitwise 10 Crypto Index ETF NYSE Arca approval grants access to BTC, ETH, XRP, and more via a market-cap weighted crypto fund. The post Bitwise 10 Crypto Index ETF debuts on NYSE Arca with BTC, ETH, and XRP exposure appeared first on Crypto Briefing.

Bitcoin Is a Relief, Not a Theory: Pakistan’s Case for Crypto Adoption

Bitcoin Is a Relief, Not a Theory: Pakistan’s Case for Crypto AdoptionBitcoin Magazine Bitcoin Is a Relief, Not a Theory: Pakistan’s Case for Crypto Adoption Pakistan's Bilal Bin Saqib argued that in Pakistan bitcoin is not a speculative theory but a practical financial lifeline — offering inflation protection, permissionless access for the unbanked and a means for global payments. This post Bitcoin Is a Relief, Not a Theory: Pakistan’s Case for Crypto Adoption first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Michael Saylor Pitched Bitcoin To ‘Every’ Middle East Sovereign Wealth Fund

Michael Saylor Pitched Bitcoin To ‘Every’ Middle East Sovereign Wealth FundIn a fireside chat with Metaplanet CEO Simon Gerovich at BTC MENA 2025, Michael Saylor turned a technical conversation about Bitcoin treasuries into a direct pitch to the Middle East’s sovereign wealth funds and banks, outlining how a nation or large financial institution could attract tens of trillions of dollars and become the “Switzerland” of […]

Jack Maller’s Twenty One Capital debuts on NYSE

Jack Maller’s Twenty One Capital debuts on NYSETwenty One Capital launched on the NYSE with strong institutional backing and a massive Bitcoin treasury.

![[LIVE] Bitcoin Price Alert: September and October JOLTS Data Drops Today — Will Job Openings Shift Fed Rate Decision?](https://cimg.co/wp-content/uploads/2025/12/09145548/1765292147-image-1765292117918_optimized.jpg) [LIVE] Bitcoin Price Alert: September and October JOLTS Data Drops Today — Will Job Openings Shift Fed Rate Decision?

[LIVE] Bitcoin Price Alert: September and October JOLTS Data Drops Today — Will Job Openings Shift Fed Rate Decision?Two months of JOLTS data releases 10am ET—last employment signal before Fed decides on rate cuts tomorrow. The post [LIVE] Bitcoin Price Alert: September and October JOLTS Data Drops Today — Will Job Openings Shift Fed Rate Decision? appeared first on Cryptonews.

Bitcoin Enters December with Mixed Signals as Miner Stress and Whale Accumulation Create Tug-of-War

Bitcoin Enters December with Mixed Signals as Miner Stress and Whale Accumulation Create Tug-of-WarBitcoin enters December with a historically mixed track record, often characterized by sharp outliers and erratic flows.

XRP analysis, DOGE outlook and why Poain will capture the AI market in 2026

XRP analysis, DOGE outlook and why Poain will capture the AI market in 2026The crypto market remains volatile as BTC, XRP and other coins attempt a recovery, while AI platforms like Poain emerge as strong performers. #sponsored

Standard Chartered: Bitcoin Halving Cycles Are Over

Standard Chartered: Bitcoin Halving Cycles Are OverThe old halving-driven price peaks are not a reliable guide anymore, according to Standard Chartered.

Is Bitcoin Miner Capitulation A Golden Opportunity?

Is Bitcoin Miner Capitulation A Golden Opportunity?Bitcoin Magazine Is Bitcoin Miner Capitulation A Golden Opportunity? Every major bitcoin miner capitulation (2018, 2022, now) marked generational buying zones. Don’t miss this one! This post Is Bitcoin Miner Capitulation A Golden Opportunity? first appeared on Bitcoin Magazine and is written by Matt Crosby.

On the eve of a BTC breakout, Anchor Mining users earned $3,977; No market monitoring required

On the eve of a BTC breakout, Anchor Mining users earned $3,977; No market monitoring requiredInstitutions expect a BTC rebound, but Anchor Mining steals attention as users earn up to $3,977 daily from stable hashrate output. Despite Bitcoin’s prolonged decline, major institutions still predict a rapid rebound once the pressure subsides. JPMorgan analysts recently reiterated…

Has Congress quietly forced the Department of War to use Bitcoin to bankrupt Chinese hackers?

Has Congress quietly forced the Department of War to use Bitcoin to bankrupt Chinese hackers?The House’s new fiscal 2026 defense bill directs the Pentagon to develop options to impose costs on state-backed hackers who target defense-critical infrastructure in cyberspace. Section 1543 of the chamber’s amendment orders the Under Secretary of Defense for Policy and the Chairman of the Joint Chiefs of Staff, highlighted by Jason Lowery, in consultation with […] The post Has Congress quietly forced the Department of War to use Bitcoin to bankrupt Chinese hackers? appeared first on CryptoSlate.

PNC Bank Rolls Out Spot Bitcoin Access for Private Clients After 2025 Reveal

PNC Bank Rolls Out Spot Bitcoin Access for Private Clients After 2025 RevealThe Coinbase-backed feature, first announced in July, lets PNC clients buy, sell and hold bitcoin directly in their digital banking accounts.

Analyst Predicts Bitcoin Price Crash To $15,000 Using Gold Chart

Analyst Predicts Bitcoin Price Crash To $15,000 Using Gold ChartFollowing the Bitcoin price crash below $100,000 back in November, different bearish predictions have begun to make the rounds in the crypto community. For some, this crash signifies the end of the bull market, ushering in the dreaded bear market. While some of the predictions have been conservative, putting the pioneer cryptocurrency somewhere around $50,000 […]

Is the BTC cycle dead? Why analysts predict $150K Bitcoin by 2026

Is the BTC cycle dead? Why analysts predict $150K Bitcoin by 2026Spot Bitcoin ETF resilience drives Bernstein’s bold forecast: $150K in 2026, $1M by 2033.

XRP Secures $1B AUM Milestone, Sets ETF Speed Record In The US

XRP Secures $1B AUM Milestone, Sets ETF Speed Record In The USXRP Spot ETFs have nearly crossed the $1 billion mark in assets under management (AUM), marking one of the quickest ramps since Ethereum, according to Ripple’s CEO. Related Reading: All-In On XRP: Why This Leading Investor Sold His Entire Bitcoin Stack Rapid Fund Growth In Weeks According to the disclosure, the four XRP ETF products now hold about $1.23B in total net assets, which equals 597 million XRP at a reported XRP price of $2.06. Reports have disclosed a fresh inflow of $30 million on Monday, Dec. 8, and the cumulative net inflow into these products stands close to $935 million. Ripple CEO Brad Garlinghouse highlighted that the collective figure reached the $1 billion level in under four weeks after the first fund hit the market. Canary Capital Leads With Heavy Flows Canary Capital’s XRPC grabbed the most attention at launch, bringing roughly $245 million in net flows on its debut day on Nov. 13. Canary’s fund holds about 335.889 million XRP, valued at approximately $691 million, which represents 56% of the combined assets across the four funds. 👀<4 weeks, and XRP is now the fastest crypto Spot ETF to reach $1B in AUM (since ETH) in the US. With over 40 crypto ETFs launched this year in the US alone, a few points are obvious to me: 1/ there’s pent up demand for regulated crypto products, and with Vanguard opening up… — Brad Garlinghouse (@bgarlinghouse) December 8, 2025 The other managers hold smaller shares: Grayscale’s product holds 104.381 million XRP, about $215 million or 17.47% of the total; Bitwise carries 93.827 million XRP valued at $193.284 million or 15.7%; Franklin Templeton has 62.99 million XRP worth about $131.829 million, or 10.71%. A Wave Of Approved Crypto Funds Based on reports, this development follows a broader rollout of spot and futures crypto ETFs since US spot Bitcoin ETFs arrived in January 2024. Ethereum spot products launched in July 2024, and Solana listings came in October 2025. The US Securities and Exchange Commission has approved more than 40 crypto-related ETF products this year, which market participants say has opened familiar rails for mainstream investors. Vanguard’s choice to allow crypto access inside standard retirement and broker accounts is being cited as a change that lets many Americans gain exposure without deep crypto know-how. What This Means For Investors According to analysts and market observers, the speed of these flows underlines strong demand for regulated crypto vehicles. Big-name asset managers entering the market have helped create options that look and act like other mutual funds or ETFs, which can ease the path for retirement plans and advisers to take part. At the same time, a large share resting in a single debut fund shows concentration risk: Canary’s XRPC accounts for more than half of the total net assets, and that matters for liquidity and fund dynamics if flows shift. Related Reading: Banking Meets Bitcoin: French Banking Giant Offers Crypto To Millions Fresh Inflows & ETF Demand While $1.23 billion is a headline figure, market watchers will be watching fresh inflows, trading volumes, and how price moves react to ETF demand. For now, XRP listings have drawn sizable attention, and the coming weeks should make clearer whether the early momentum will spread more evenly across products and push broader investor participation. Featured image from Unsplash, chart from TradingView

Here’s what happened in crypto today

Here’s what happened in crypto todayNeed to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation.

Banking giant PNC teams with Coinbase to enable direct Bitcoin trading for wealthy clients

Banking giant PNC teams with Coinbase to enable direct Bitcoin trading for wealthy clientsThis collaboration signifies a pivotal shift towards mainstream crypto integration, potentially reshaping wealth management and banking services. The post Banking giant PNC teams with Coinbase to enable direct Bitcoin trading for wealthy clients appeared first on Crypto Briefing.

Morning Minute: Saylor and Tom Lee Buy Big

Morning Minute: Saylor and Tom Lee Buy BigStrategy and BitMine have calmed concerns that they may be tapped out with massive BTC and ETH purchases respectively. So what's the impact?

Standard Chartered halves Bitcoin price forecast to $100K by year-end

Standard Chartered halves Bitcoin price forecast to $100K by year-endThe revised forecast highlights potential challenges for Bitcoin's growth, emphasizing the need for increased institutional support and favorable policies. The post Standard Chartered halves Bitcoin price forecast to $100K by year-end appeared first on Crypto Briefing.

Standard Chartered Throws in the Towel on Bullish Bitcoin Forecast

Standard Chartered Throws in the Towel on Bullish Bitcoin ForecastBowing to what he called a "cold breeze," but not a "crypto winter," Geoff Kendrick slashed his year-end outlook for BTC to $100,000 and doesn't expect $500,000 until 2030 versus 2028 previously.

Dogecoin Price Will Rally Before It Crashes, But What’s The Target?

Dogecoin Price Will Rally Before It Crashes, But What’s The Target?The Dogecoin price is already struggling amid the bearish pressure that has dominated the crypto market recently. After the initial fall to $0.2, DOGE bulls had attempted to hold support, pushing for a rebound. However, with the bearish headwinds of the last quarter of the year, the Dogecoin price has since succumbed and is now trading below the $0.15 support level, and continues to struggle. Despite the already troubling price performance, crypto analyst Weslad says that the worst might be yet to come. This is due to a corrective structure that has appeared on the meme coin’s price chart, and the result of this has been a bearish flag. As these technical developments unfold, the crypto analyst has warned investors of what to expect, outlining why the Dogecoin price could see a major crash while attempting to recover. Dogecoin Price To Rise And Then Fall The analysis, which was shared on the TradingView website, points to the bearish flag as a precursor of what is to come. Weslad explains that the bearish flag had triggered the Dogecoin price breakdown that had led to the downward leg. As a result, the sentiment has skewed negative so far, suggesting that there could be more declines to come. Related Reading: Bitcoin RSI Shows Shocking Similarities To 2012-2015, But What Happened Last Time? However, the crypto analyst points out that the Dogecoin price is still well below its breakout zone. Given this, it is likely that there could be an initial relief rally for the meme coin. If this rally plays out, then there would be an initial decline below $0.12 to form support above $0.118. Once this support is established, then the resulting bounce is expected to push the Dogecoin price to $0.2. Once this move is completed, though, the analyst predicts an even deeper crash on the horizon. From the $0.2 mark, Weslad’s chart shows that the Dogecoin price could decline another 70%, falling toward $0.05 in the process, which would mean a return to 2-year lows. Related Reading: Confirming The Bitcoin Price Direction: Analyst Reveals What You Should Look Out For “The immediate plan is to monitor a pullback toward the minimum bearish flag targets around the $0.12 region, which aligns with the former structure support and breakout zone,” the crypto analyst said. This bottom area serves as a “supply on the retest” and could trigger the next decline. For now, the analyst expects that the Dogecoin price will continue on its bearish path. This is dependent on the broader market performance, and so far, a breakdown looks to be more likely. Featured image from Dall.E, chart from TradingView.com

Dogecoin ETFs lose their bite as Bitcoin, Ethereum big dogs lead the pack

Dogecoin ETFs lose their bite as Bitcoin, Ethereum big dogs lead the packThe total value traded for spot DOGE ETFs reached its lowest point since launch, signaling a fading of the early hype as liquidity and flows lag well behind those of major crypto ETFs.

Standard Chartered Slashes 2025 Bitcoin Forecast to $100K

Standard Chartered Slashes 2025 Bitcoin Forecast to $100KThe bank has cut its 2025 Bitcoin price target by half, citing the end of corporate buying and sharply slowing ETF inflows.

The CFTC just authorized Bitcoin, ETH, USDC only for US leverage, leaving XRP, SOL stranded in risky limbo

The CFTC just authorized Bitcoin, ETH, USDC only for US leverage, leaving XRP, SOL stranded in risky limboThe United States has signaled a clear distinction between crypto assets suitable for trading and those best suited for use as collateral in the derivatives markets. On Dec 8, the Commodity Futures Trading Commission (CFTC) authorized Futures Commission Merchants (FCMs) to accept Bitcoin, Ethereum, and USDC as eligible margin under a digital assets pilot program. […] The post The CFTC just authorized Bitcoin, ETH, USDC only for US leverage, leaving XRP, SOL stranded in risky limbo appeared first on CryptoSlate.

Why Is Crypto Down Today? – December 9, 2025

Why Is Crypto Down Today? – December 9, 2025The crypto market is down today. BTC decreased by 1.1% to $90,480, and ETH is down by 0.3% to $3,122. “All eyes are on Bitcoin’s $91,000 resistance level.” The post Why Is Crypto Down Today? – December 9, 2025 appeared first on Cryptonews.

Bitcoin's ‘bear flag pattern’ targets $67K as BTC spot demand slumps

Bitcoin's ‘bear flag pattern’ targets $67K as BTC spot demand slumpsThe absence of new buyers and weakening ETF demand are factors likely to keep the Bitcoin price pinned below $93,000 as a bear flag targets $67,000.

SoftBank-backed Twenty One to begin trading on NYSE today with over 43,500 Bitcoin

SoftBank-backed Twenty One to begin trading on NYSE today with over 43,500 BitcoinTwenty One's NYSE debut could bolster Bitcoin's legitimacy in global markets, potentially increasing institutional interest and adoption. The post SoftBank-backed Twenty One to begin trading on NYSE today with over 43,500 Bitcoin appeared first on Crypto Briefing.

BCH Price Prediction: Bitcoin Cash Eyes $625 Short-Term Target Amid Bullish Technical Setup

BCH Price Prediction: Bitcoin Cash Eyes $625 Short-Term Target Amid Bullish Technical SetupBitcoin Cash shows bullish momentum with MACD divergence supporting a BCH price prediction of $625 in the next 7-10 days, with medium-term targets reaching $700-$800. (Read More)

- Standard Chartered Sounds Alarm: A Major Bitcoin Buyer Has Disappeared

Standard Chartered has lowered its long-term Bitcoin (BTC) price forecasts, warning that a key pillar of recent demand, corporate Bitcoin buying, is likely over. The bank now believes future gains in Bitcoin will be driven by a single source: exchange-traded fund (ETF) inflows, a shift that could slow the pace of upside in the years The post Standard Chartered Sounds Alarm: A Major Bitcoin Buyer Has Disappeared appeared first on BeInCrypto.

Leverage vanishes from Bitcoin perps as funding rates and open interest sink

Leverage vanishes from Bitcoin perps as funding rates and open interest sinkBitcoin perpetual futures open interest has stayed below 310K BTC since October’s liquidation, signaling muted leverage and weaker speculative activity. Bitcoin’s (BTC) perpetual futures market has experienced a significant decline in speculative activity, with Open Interest remaining at suppressed levels,…

Will the Fed Crash Bitcoin (BTC) or Spark a $100K Rally?

Will the Fed Crash Bitcoin (BTC) or Spark a $100K Rally?Bitcoin (BTC) trades above $90K ahead of the Fed meeting, with analysts split on a breakout to $100K or a possible drop to $70K or lower.

Morning Crypto Report: Ripple CTO Says XRP Holdings Are Undervalued, Andrew Tate Declares He's 'Huge on Bitcoin,' Solana Drops Rare XRP Mention

Morning Crypto Report: Ripple CTO Says XRP Holdings Are Undervalued, Andrew Tate Declares He's 'Huge on Bitcoin,' Solana Drops Rare XRP MentionTuesday opens with Solana throwing "589" into the XRP feed, Ripple's CTO pushing back on how markets price the firm's XRP holdings and Andrew Tate questioning why giant Bitcoin buys barely move anything.

BTC Price Prediction: Bitcoin Eyes $125,000 Rally by Christmas Despite Current $90K Consolidation

BTC Price Prediction: Bitcoin Eyes $125,000 Rally by Christmas Despite Current $90K ConsolidationBTC price prediction suggests potential 38% surge to $125,000 by year-end, though critical $96K-$106K range must hold to avoid $80K downside risk. (Read More)

Bitcoin (BTC) Retreats to $90K, Hyperliquid (HYPE) Plunges by 9% Daily: Market Watch

Bitcoin (BTC) Retreats to $90K, Hyperliquid (HYPE) Plunges by 9% Daily: Market WatchThe total cryptocurrency market capitalization slid to around $3.15 trillion.

Coinbase Adds PLUME Crypto and JUPITER as Year-End Liquidity Tightens Across Crypto Markets

Coinbase Adds PLUME Crypto and JUPITER as Year-End Liquidity Tightens Across Crypto MarketsCoinbase just opened spot trading for Plume Crypto and Jupiter coin on December 9, giving both assets direct access to one of the world’s largest regulated exchanges. Trading for PLUME-USD and JUPITER-USD went live after 9 AM PT once liquidity thresholds are met. Risk asset bros, we are so BACK. Institutions will also receive full.. The post Coinbase Adds PLUME Crypto and JUPITER as Year-End Liquidity Tightens Across Crypto Markets appeared first on 99Bitcoins.

- [LIVE] Crypto News Today, December 9 – Bitcoin Dips on FOMC Nerves, Whale Loads Up on ETH, BTC ETF Flows Turn Red: Next Crypto to Explode?

The market appears cautious today, with total capitalization close to $3.2 trillion as the Federal Open Market Committee (FOMC) begins its two-day meeting. , after scaling $92,000 yesterday, dipped below $90,000 before stabilizing. It currently sits at $90,370, up 0.5% over 24 hours amid persistent volatility, leaving traders scanning the market for the next crypto.. The post [LIVE] Crypto News Today, December 9 – Bitcoin Dips on FOMC Nerves, Whale Loads Up on ETH, BTC ETF Flows Turn Red: Next Crypto to Explode? appeared first on 99Bitcoins.

Bitcoin Speculation Muted: Glassnode Analyst Calls Perps A ‘Ghost Town’

Bitcoin Speculation Muted: Glassnode Analyst Calls Perps A ‘Ghost Town’Glassnode’s senior researcher has pointed out how Bitcoin perpetual futures market is looking like a “ghost town,” with Open Interest continuing to be at muted levels. Bitcoin Futures Open Interest Has Remained Low Since October Reset In a new post on X, Glassnode senior researcher CryptoVizArt.₿ has talked about the recent trend in the Bitcoin Open Interest for the perpetual futures market. The “Open Interest” refers to an indicator that measures the total amount of positions related to the asset that are currently open on all centralized derivatives platforms. Related Reading: This 11.7 Billion Dogecoin Wall Could Be Key Resistance For DOGE, Analyst Says When the value of the metric rises, it means the investors are opening new positions related to the asset. Generally, new positions come with fresh leverage for the sector, so the cryptocurrency’s price can become more volatile following an increase in the Open Interest. On the other hand, the indicator going down suggests the perpetual futures traders are either closing up position of their own volition or getting forcibly liquidated by their platform. Such a trend can lead to more stable price action for BTC due to the clearing of leverage. Now, here is the chart shared by CryptoVizArt.₿ that shows the trend in the Bitcoin perpetual futures Open Interest (BTC-denominated) over the last few months: As displayed in the above graph, the BTC-denominated Bitcoin perpetual futures Open Interest saw a sharp plunge back in October as a result of the crash in the cryptocurrency’s price. Following the leverage flush, the indicator traveled sideways around its lows, but in mid-November, speculation noted an uptick as the asset’s drawdown continued, with the metric’s value peaking alongside the level that has so far acted as the bottom. Since this high, however, the indicator has cooled off once again and approached the same lows as the ones that followed the massive liquidation event in October. Thus, with Open Interest back under 310,000 BTC, it seems speculative interest in the market has once again become muted. The recent decline in speculative participation has come alongside a drop in the perpetual futures Funding Rate, a metric tracking the amount of periodic fee being exchanged between the short and long investors. From the chart, it’s visible that the Bitcoin perpetual futures Funding Rate has been going down since a while now. “This persistent drift lower reflects a decline in leveraged long conviction, with traders unwilling to pay a premium to maintain upside exposure,” noted the Glassnode researcher. Related Reading: Bitcoin Market Structure Echoes 2022 Bear Start, Glassnode Warns Based on the recent developments, CryptoVizArt.₿ has called the perpetual futures market a “ghost town.” BTC Price At the time of writing, Bitcoin is floating around $90,500, up almost 6% over the last seven days. Featured image from Dall-E, Glassnode.com, chart from TradingView.com

Crypto Casino Bitcoin VIP-promotions and perks that BIG players get

Crypto Casino Bitcoin VIP-promotions and perks that BIG players getSince there is a plethora of options all over the web, it may seem like […]

Cardano Price Defends $0.40 But Targets Downside as Binance Back NIGHT Crypto

Cardano Price Defends $0.40 But Targets Downside as Binance Back NIGHT CryptoMy wife left me because I couldn’t stop buying at this Cardano price…but she won’t be sneering when ADA USD goes to $18-$20. Right, anon? Right?! When I told my financial advisor this, he said, “Based anon, never give up on your dreams or whatever you call that.” So, anyway, why has the price action.. The post Cardano Price Defends $0.40 But Targets Downside as Binance Back NIGHT Crypto appeared first on 99Bitcoins.

New Bitcoin Crash Incoming? Twenty One Capital Moves 43,500 BTC Amid Major Losses

New Bitcoin Crash Incoming? Twenty One Capital Moves 43,500 BTC Amid Major LossesTwenty One Capital, a major player in the Bitcoin (BTC) treasury sector founded by Jack Mallers, is on the verge of going public in the United States. However, ahead of its highly anticipated debut on December 9, the company has moved a substantial sum of 43,500 BTC—approximately worth $4.5 billion—into an escrow wallet. This move has sparked market concerns about a potential sell-off, which could create major selling pressure for the leading cryptocurrency as it attempts to consolidate above the key $90,000 support level. $1.5 Billion Loss In Bitcoin Investments Experts on the social media platform X (formerly Twitter), such as OxNobler, have pointed out that the company is currently grappling with a significant $1.5 billion loss on its Bitcoin investment. He warned that this financial pressure could potentially lead to a new crash for Bitcoin and adversely affect the broader cryptocurrency market as well. Related Reading: Here’s How High The Dogecoin Price Will Go Once The MACD Bullish Cross Happens The apprehension surrounding this situation is reflected in Bitcoin’s price action, as the leading cryptocurrency dipped below $90,000 earlier on Monday amid growing uncertainty about its future trajectory. However, Jack Mallers had previously addressed the reasoning behind this monumental Bitcoin transfer. According to him, this step is part of the preparations for Twenty One Capital’s upcoming listing on the New York Stock Exchange (NYSE). As part of the transaction, the company is transitioning 43,500 BTC from third-party custody to a self-custody account, ensuring transparency by updating its proof of reserves accordingly. The firm, backed by major players like Tether and SoftBank, aims to take on Michael Saylor’s Bitcoin proxy firm Strategy (previously MicroStrategy) in the competitive Bitcoin treasury sector. A significant milestone was reached on December 3, when shareholders of CEP approved a business merger with Twenty One Capital, paving the way for the company’s initial public offering (IPO). Once the transactions are finalized, the combined entity will operate as Twenty One Capital, Inc., with its shares expected to begin trading on the NYSE under the ticker symbol “XXI.” Twenty One Capital Gears Up For IPO Amid the preparations for its anticipated debut in the US, the firm has indicated that it will focus exclusively on Bitcoin-related ventures, offering shareholders new opportunities to gain exposure to BTC through equity markets. With a Bitcoin-native operating framework and a long-term strategy designed for value creation, Twenty One intends to establish itself as a leading platform for capital-efficient Bitcoin accumulation and related business initiatives. Related Reading: Analysts Split on XRP Future Outlook as Centralization Debate Intensifies This move to go public follows a tumultuous period for Mallers, who disclosed that JPMorgan Chase had abruptly closed his accounts in September without explanation. “Last month, J.P. Morgan Chase threw me out of the bank… Whenever I asked them why, I received the same response: ‘We aren’t allowed to tell you,’” Mallers recounted on November 23. The closure letter cited “concerning activity” and referenced the Bank Secrecy Act, preventing him from reopening accounts at the bank. Featured image from DALL-E, chart from TradingView.com

Crypto Market News Today, December 9: Democrat Meeting for Crypto CMSB as Saylor Bought More Bitcoin, 25BPS Rate Cut Coming

Crypto Market News Today, December 9: Democrat Meeting for Crypto CMSB as Saylor Bought More Bitcoin, 25BPS Rate Cut ComingWhisper storming around Washington has pushed crypto market structure bill, or CMSB, discussions back into the space, and we can say that the timing couldn’t be more interesting. Democrats reportedly met privately to review Republicans’ compromise draft, just as we brace for a potential rate cut and renewed optimism from the latest Saylor and his.. The post Crypto Market News Today, December 9: Democrat Meeting for Crypto CMSB as Saylor Bought More Bitcoin, 25BPS Rate Cut Coming appeared first on 99Bitcoins.

US Spot BTC ETFs Bleed $60.4M as Altcoin Capital Flows Increase

US Spot BTC ETFs Bleed $60.4M as Altcoin Capital Flows IncreaseUS spot Bitcoin ETFs logged a net outflow of $60.48 million on Monday, while Ethereum and altcoin funds saw net inflows. The post US Spot BTC ETFs Bleed $60.4M as Altcoin Capital Flows Increase appeared first on Cryptonews.

Bitcoin retail inflows to Binance ‘collapse’ to 400 BTC record low in 2025

Bitcoin retail inflows to Binance ‘collapse’ to 400 BTC record low in 2025Bitcoin retail investors have been sending fewer BTC to Binance per day than at any time in history, despite the new highs of the 2025 bull market.

Bitcoin price holds firm, but analysts note rising attention on Remittix as a high-utility solution in 2026

Bitcoin price holds firm, but analysts note rising attention on Remittix as a high-utility solution in 2026Bitcoin holds steady in the high $80,000s as traders shift attention toward newer payment-focused projects showing real activity on the ground. #partnercontent

Will FOMC Trigger Parabolic QE Rally For XRP Price? Maestro Analyst Weighs In

Will FOMC Trigger Parabolic QE Rally For XRP Price? Maestro Analyst Weighs InThe XRP price narrative is heating up again as markets brace for the pivotal FOMC meeting on December 9-10, 2025. With crypto trading sideways during a tense macro reset, many analysts believe XRP could be one of the biggest beneficiaries if the Federal Reserve confirms a dovish shift. After years of quantitative tightening, shrinking liquidity,.. The post Will FOMC Trigger Parabolic QE Rally For XRP Price? Maestro Analyst Weighs In appeared first on 99Bitcoins.

Bitcoin Booster Cathie Wood Welcomes Vanguard Investors

Bitcoin Booster Cathie Wood Welcomes Vanguard InvestorsCathie Wood is welcoming Vanguard investors to Bitcoin through her ARK 21Shares Bitcoin ETF.

Bitcoin Exchange Outflows Accelerate Despite Short-Term Price Weakness

Bitcoin Exchange Outflows Accelerate Despite Short-Term Price WeaknessBitcoin is being taken off centralized crypto exchanges, which is a good thing as it potentially eases selling pressure.

Michael Saylor’s Strategy buys $962M Bitcoin despite MSCI pressure – Why?

Michael Saylor’s Strategy buys $962M Bitcoin despite MSCI pressure – Why?Is the MSCI risk overstated as Strategy doubles down on BTC?

400K Bitcoin have peeled off exchanges since last year: Santiment

400K Bitcoin have peeled off exchanges since last year: SantimentSome of the Bitcoin outflows from exchanges are going to individual users’ storage wallets, but ETFs and institutions are accumulating coins too.

Bitcoin Slips Toward ETF Break-Even Level as Inflows Slow, but Support May Be Building

Bitcoin Slips Toward ETF Break-Even Level as Inflows Slow, but Support May Be BuildingBitcoin is drifting back toward the price where ETF buyers break even, as inflows slow and investors look to the Fed’s decision this week.

Everything You Need to Know About Yearn Finance Exploit

Everything You Need to Know About Yearn Finance ExploitYearn Finance has published a detailed post-mortem on last week’s yETH exploit, explaining how a numerical flaw in one of its older stableswap pools let an attacker mint an almost unlimited amount of LP tokens and steal about $9M in assets. The DeFi platform said it has already recovered part of the stolen funds. In.. The post Everything You Need to Know About Yearn Finance Exploit appeared first on 99Bitcoins.

Michael Saylor Just Made His Biggest Bitcoin Bet of H2 2025

Michael Saylor Just Made His Biggest Bitcoin Bet of H2 2025Strategy reported its largest Bitcoin purchase in more than three months on Monday, only days after spending close to $1Bn on the cryptocurrency. The firm, based in Tysons Corner, Virginia, said it bought 10,624 BTC for $963M. Most of the funding came from issuing new common stock. The latest purchase lifts Strategy’s total holdings to.. The post Michael Saylor Just Made His Biggest Bitcoin Bet of H2 2025 appeared first on 99Bitcoins.

U.S. CFTC launches pilot for tokenized derivatives collateral

U.S. CFTC launches pilot for tokenized derivatives collateralThe Commodity Futures Trading Commission has opened the door for tokenized assets to be used across U.S. derivatives markets. The commission has launched a digital assets pilot program covering Bitcoin, Ethereum, USDC, and tokenized real-world assets. In its Dec .…

Bybit Eye Tether USDT Risk-Off: Did Bybit Just Join the Circle Cartel?

Bybit Eye Tether USDT Risk-Off: Did Bybit Just Join the Circle Cartel?Circle and Bybit, the operators behind the world’s second-largest stablecoin and the second-largest crypto exchange, are entering a new partnership that may influence how digital assets move across global markets. Bybit announced on Monday that it will give USDC a larger role across its platform. The exchange, which ranks second worldwide by trading volume, said.. The post Bybit Eye Tether USDT Risk-Off: Did Bybit Just Join the Circle Cartel? appeared first on 99Bitcoins.

Galaxy Digital transfers 900 Bitcoin to newly created wallet

Galaxy Digital transfers 900 Bitcoin to newly created walletLarge-scale Bitcoin transfers by major firms like Galaxy Digital may influence market dynamics and investor sentiment amid ongoing volatility. The post Galaxy Digital transfers 900 Bitcoin to newly created wallet appeared first on Crypto Briefing.

CFTC pilot opens path for crypto as collateral in derivative markets

CFTC pilot opens path for crypto as collateral in derivative marketsThe pilot program allows futures commission merchants to accept Bitcoin, Ether and USDC for margin collateral, provided strict reporting criteria are followed.

The “infinite money glitch” fueling Strategy and BitMine has evaporated, forcing a desperate pivot to survive

The “infinite money glitch” fueling Strategy and BitMine has evaporated, forcing a desperate pivot to surviveThe two largest crypto treasury companies, Bitcoin-focused Strategy (formerly MicroStrategy) and Ethereum-heavy BitMine, executed significant expansions of their digital asset treasuries this week despite their falling premium. On Dec. 8, Strategy revealed that it acquired 10,624 BTC last week for $962.7 million, its largest weekly outlay since July. This purchase effectively ignored the broader signal […] The post The “infinite money glitch” fueling Strategy and BitMine has evaporated, forcing a desperate pivot to survive appeared first on CryptoSlate.

Strategy expands Bitcoin holdings despite stock struggles

Strategy expands Bitcoin holdings despite stock strugglesStrategy stock remains in a prolonged downtrend. Still, its total Bitcoin holdings are around 660,624 BTC, worth about $49.35 billion.

10x Research founder warns of 60% Bitcoin drop tied to 2026 US midterms

10x Research founder warns of 60% Bitcoin drop tied to 2026 US midtermsA potential Bitcoin drop could impact investor confidence, highlighting the need for strategic risk management amid macroeconomic uncertainties. The post 10x Research founder warns of 60% Bitcoin drop tied to 2026 US midterms appeared first on Crypto Briefing.

Crypto Market Prediction: No Bitcoin, $100,000 Next Time, Is Shiba Inu (SHIB) Wearing Bull Horns Again? XRP Becoming Dominant

Crypto Market Prediction: No Bitcoin, $100,000 Next Time, Is Shiba Inu (SHIB) Wearing Bull Horns Again? XRP Becoming DominantThe market is certainly not ready for a rapid reversal, but at the same time, there are solid institutional inflows that can turn the situation around sooner rather than later.

Bitcoin wallets holding over 0.1 BTC decline for first time in two-year period

Bitcoin wallets holding over 0.1 BTC decline for first time in two-year periodTrend watch: Modern Bitcoin infrastructure, with ETFs and exchanges, reduces the need for large balances in single addresses.

CFTC to Pilot Tokenized Collateral in Derivatives Markets Starting With Bitcoin, Ethereum and USDC

CFTC to Pilot Tokenized Collateral in Derivatives Markets Starting With Bitcoin, Ethereum and USDCThe CFTC has introduced a pilot allowing Bitcoin, Ethereum, and USDC to be used as margin, while updating rules to support tokenized assets.

CFTC Launches Pilot Program Allowing Bitcoin To Be Used as Collateral In Derivatives Markets

CFTC Launches Pilot Program Allowing Bitcoin To Be Used as Collateral In Derivatives MarketsBitcoin Magazine CFTC Launches Pilot Program Allowing Bitcoin To Be Used as Collateral In Derivatives Markets The CFTC launched a U.S. pilot program allowing Bitcoin to be used as collateral in regulated derivatives markets. This post CFTC Launches Pilot Program Allowing Bitcoin To Be Used as Collateral In Derivatives Markets first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

CFTC launches digital assets pilot, allowing Bitcoin and Ethereum as collateral

CFTC launches digital assets pilot, allowing Bitcoin and Ethereum as collateralThe CFTC launched a digital asset pilot allowing BTC, ETH, and USDC as derivatives collateral under the GENIUS Act. The post CFTC launches digital assets pilot, allowing Bitcoin and Ethereum as collateral appeared first on Crypto Briefing.

Bitcoin vs. Ethereum: Which Crypto Makes The Nice List This December? (Op-ed)

Bitcoin vs. Ethereum: Which Crypto Makes The Nice List This December? (Op-ed)Bitcoin and Ethereum both crashed about 12% in November and over 30% in Q4. But these reasons will determine which coin performs better in December.

Crypto Markets Flash Green, But Bitcoin and Ethereum Are in a Death Cross: Analysis

Crypto Markets Flash Green, But Bitcoin and Ethereum Are in a Death Cross: AnalysisMarkets open in green after a week of recovery, but the movement isn't enough to call it bullish yet. The death cross looms large over both Bitcoin and Ethereum.

Peter Brandt Reveals Shocking Bitcoin Price Target, Ripple CTO Doubles Down on XRP Ledger, Shiba Inu Faces Extreme On-Chain Anomaly – Crypto News Digest

Peter Brandt Reveals Shocking Bitcoin Price Target, Ripple CTO Doubles Down on XRP Ledger, Shiba Inu Faces Extreme On-Chain Anomaly – Crypto News DigestCrypto market today: Shiba Inu sees an enormous exchange outflow; David Schwartz explains his XRP Ledger push; BTC just picked up a warning from trading legend.

Strategy’s Michael Saylor Met With Middle East Sovereign Wealth Funds to Pitch Bitcoin-Backed Credit

Strategy’s Michael Saylor Met With Middle East Sovereign Wealth Funds to Pitch Bitcoin-Backed CreditBitcoin Magazine Strategy’s Michael Saylor Met With Middle East Sovereign Wealth Funds to Pitch Bitcoin-Backed Credit Strategy’s Michael Saylor claims he met with every Middle East sovereign wealth fund to pitch Bitcoin-backed credit, positioning digital capital as a yield-generating alternative to traditional fixed income. This post Strategy’s Michael Saylor Met With Middle East Sovereign Wealth Funds to Pitch Bitcoin-Backed Credit first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Anthony Scaramucci praises Strategy’s new Bitcoin investment as ‘smart stuff’

Anthony Scaramucci praises Strategy’s new Bitcoin investment as ‘smart stuff’Scaramucci's endorsement highlights growing institutional confidence in Bitcoin, potentially accelerating its adoption as a mainstream asset. The post Anthony Scaramucci praises Strategy’s new Bitcoin investment as ‘smart stuff’ appeared first on Crypto Briefing.

4 Ways Trump’s New Fed Chair Could Supercharge Bitcoin’s Price

4 Ways Trump’s New Fed Chair Could Supercharge Bitcoin’s PriceU.S. President Donald Trump is zeroing in on a new Fed Chair nominee. This could be a huge support for big gains in Bitcoin’s price.

Strategy’s Stockpile Swells To 660,624 BTC After Scooping Up Nearly $1B In Bitcoin Last Week

Strategy’s Stockpile Swells To 660,624 BTC After Scooping Up Nearly $1B In Bitcoin Last WeekStrategy added 10,624 Bitcoin between Dec.1 and Dec. 7 for $962.7 million— its largest purchase since July.

Argentina Considers Letting Domestic Banks Trade Cryptocurrencies Such As Bitcoin

Argentina Considers Letting Domestic Banks Trade Cryptocurrencies Such As BitcoinArgentina is reportedly considering whether to allow traditional financial institutions to trade digital assets such as Bitcoin and offer crypto-related services.

Bitcoin is tracking a hidden $400 billion Fed liquidity signal that matters more than rate cuts

Bitcoin is tracking a hidden $400 billion Fed liquidity signal that matters more than rate cutsBitcoin’s price action continues to drift into the Federal Reserve’s final policy decision of the year with little outward volatility, yet the underlying market structure reflects a very different reality. What appears to be a stable range is concealing a period of concentrated stress, as on-chain data shows that investors are realizing close to $500 […] The post Bitcoin is tracking a hidden $400 billion Fed liquidity signal that matters more than rate cuts appeared first on CryptoSlate.

Bitcoin ETF Giant BlackRock Files to Launch Ethereum Staking ETF

Bitcoin ETF Giant BlackRock Files to Launch Ethereum Staking ETFInvestment firm BlackRock filed the S-1 registration statement for a new Ethereum staking ETF, ETHB, separate from its existing ETHA fund.

Bitcoin Hovers Around $90,000 as Saylor Reveals $960 Million Buy

Bitcoin Hovers Around $90,000 as Saylor Reveals $960 Million BuyAltcoins trade mixed as the total crypto market capitalization slips 0.7% to $3.16 trillion.

Bitcoin ETFs Pull in $352 Million to Extend Rebound While XRP Funds Remain Hot

Bitcoin ETFs Pull in $352 Million to Extend Rebound While XRP Funds Remain HotBitcoin ETFs capture $352 million as bearish bets retreat, hinting investor pessimism may have reached its low point.

Key Reason Why Bitcoin Isn’t at $20K Named by Bloomberg

Key Reason Why Bitcoin Isn’t at $20K Named by BloombergSuitcoiners are the reason why BTC is trading at $90,000 instead of $20,000, according to Bloomberg's leading .

- Bitcoin Price Holding Above $85,000. Are We Out Of The Woods?

Bitcoin Price has been nothing but steady over the past two weeks. That is no surprise, but the question is: What comes next? This month will be very interesting as the FED flies blind when it comes to a rate cut decision. It has been a week since the end of Quantitative Tightening, yet the.. The post Bitcoin Price Holding Above $85,000. Are We Out Of The Woods? appeared first on 99Bitcoins.

When immortal AIs start saving in Bitcoin forever, what happens to BTC built for humans?

When immortal AIs start saving in Bitcoin forever, what happens to BTC built for humans?The machine that never ages Picture a wallet that never ages. No heirs, no estate, no retirement date, a machine adding sats, rolling UTXOs, and bidding the minimum fee for centuries. By 2125, its balance towers over most treasuries; its only preference is to keep existing. Somewhere, a miner includes its quiet, patient heartbeat in […] The post When immortal AIs start saving in Bitcoin forever, what happens to BTC built for humans? appeared first on CryptoSlate.

'Really Smart Stuff': Anthony Scaramucci Backs Saylor's Latest Billion-Dollar Bitcoin Play

'Really Smart Stuff': Anthony Scaramucci Backs Saylor's Latest Billion-Dollar Bitcoin PlayThe founder of SkyBridge Capital gave a sudden nod to Saylor's latest 10,624 BTC move, pointing to a deeper read of Strategy's equity-to-Bitcoin cycle.

Here’s why the crypto market is going up today (Dec. 8)

Here’s why the crypto market is going up today (Dec. 8)The crypto market is going up today, Dec. 8, with Bitcoin and most altcoins being in the green. Bitcoin (BTC) price rose to $92,000, while the market valuation of all tokens jumped by 2.63% in the last 24 hours to…

Bitcoin (BTC) Price Analysis for December 8

Bitcoin (BTC) Price Analysis for December 8Can bulls keep the rate of Bitcoin (BTC) above $90,000 over the next few days?.

- Trump Tariff Whale’s $100M ETH Long Bet as ETH USD Faces Supply Shock: Ethereum Price Prediction Ready to Explode?

Another week grinding above $3,000, another “is this it?” moment. Most of us are running on coffee and hopium at this point, quietly wondering if we’ll ever get a clean breakout again. Yet while the timeline stays stuck in cautious mode, one legendary whale that perfectly timed the short right before Trump’s tariffs announcement, just.. The post Trump Tariff Whale’s $100M ETH Long Bet as ETH USD Faces Supply Shock: Ethereum Price Prediction Ready to Explode? appeared first on 99Bitcoins.

Strategy Drops Nearly $1 Billion on Bitcoin, Marking Largest BTC Buy in Months

Strategy Drops Nearly $1 Billion on Bitcoin, Marking Largest BTC Buy in MonthsStrategy unveiled its largest Bitcoin purchase in over 100 days, but the company's stock price was little changed on Monday.

Binance Bags Three Licenses: Becomes The First To Secure Global License Under ADGM

Binance Bags Three Licenses: Becomes The First To Secure Global License Under ADGMBinance just secured three fresh licenses from the Financial Services Regulatory Authority (FSRA) in ADGM (Abu Dhabi Global Markets). The largest crypto exchange is now the first crypto exchange to secure a global license under its framework. FSRA, for those who don’t know, is the financial watchdog that oversees financial activities within ADGM, Abu Dhabi’s.. The post Binance Bags Three Licenses: Becomes The First To Secure Global License Under ADGM appeared first on 99Bitcoins.

BTC price fails to clear $92,000, signaling a bearish dead-cat bounce

BTC price fails to clear $92,000, signaling a bearish dead-cat bounceBitcoin (BTC) price is showing early signs of exhaustion after an impulsive rise from the 0.618 value area low. However, the absence of strong volume behind the move casts doubt on the sustainability of a rally.

Quantum Computers Killing Bitcoin? '$1 Million BTC' Advocate Samson Mow Says No Need to Worry

Quantum Computers Killing Bitcoin? '$1 Million BTC' Advocate Samson Mow Says No Need to WorryQuantum panic is back on the timeline, but JAN3 CEO Samson Mow cuts through it, saying Bitcoin is not the asset that breaks in a quantum scenario; it is everything around it that fails first.

FOMC Preview: Is Bitcoin’s Recovery in Jeopardy?

FOMC Preview: Is Bitcoin’s Recovery in Jeopardy?Analysts warn past two Fed cuts led to brief bounces followed by weeks of BTC weakness, driven by leverage and stablecoin flows.

Bitcoin is no tulip, says ETF analyst Eric Balchunas

Bitcoin is no tulip, says ETF analyst Eric BalchunasBloomberg’s Eric Balchunas rebuts Bitcoin–tulip comparisons, citing 17 years of recoveries, ETF demand, and halving-driven scarcity as proof of lasting asset value. Bloomberg ETF analyst Eric Balchunas has challenged comparisons between Bitcoin and the Dutch tulip mania of 1637, citing…

Strategy Announces a Huge Bitcoin Purchase, It Now Holds Over 660,000 BTC

Strategy Announces a Huge Bitcoin Purchase, It Now Holds Over 660,000 BTCThe company spent almost $1 billion to increase its BTC stash.

Bitcoin Price Analysis: What Are the Odds of BTC Goin Back to $82K This Week?

Bitcoin Price Analysis: What Are the Odds of BTC Goin Back to $82K This Week?Bitcoin continues to hover inside a corrective structure, with price compressing between major supply and demand zones after multiple failed attempts to break higher. Recent price action suggests the market may be transitioning from heavy selling to early re-accumulation, though buyers have yet to show convincing strength. Technical Analysis By Shayan The Daily Chart Bitcoin […]

BREAKING: Strategy Announces Biggest Bitcoin Purchase in Months