LaunchAI Analysis

Track Launch news with AI-powered analysis and real-time market sentiment. Get breaking headlines, price movements, protocol updates, and regulatory developments—all analyzed by our AI for instant insights.

- NEW

Jack Mallers’ Twenty One Capital Vows to Buy ‘As Much Bitcoin as Possible’

Jack Mallers’ Twenty One Capital Vows to Buy ‘As Much Bitcoin as Possible’Bitcoin Magazine Jack Mallers’ Twenty One Capital Vows to Buy ‘As Much Bitcoin as Possible’ Jack Mallers’ Twenty One Capital launched on the NYSE as he pledged to buy as much Bitcoin as possible. This post Jack Mallers’ Twenty One Capital Vows to Buy ‘As Much Bitcoin as Possible’ first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

- NEW

Privacy-Centric Version of Circle's USDC Stablecoin Rolling Out via Aleo Network

Privacy-Centric Version of Circle's USDC Stablecoin Rolling Out via Aleo NetworkA new privacy-focused stablecoin powered by Circle's xReserve platform is launching on the testnet of layer-1 blockchain, Aleo.

- NEW

PNC Bank launches Bitcoin trading for eligible clients via Coinbase integration

PNC Bank launches Bitcoin trading for eligible clients via Coinbase integrationThe move makes PNC the first major US bank to offer spot Bitcoin trading within its own digital platform, starting with private bank clients.

- NEW

Privacy-Centric Version of Circle's USDC Stablecoin Rolling Out via Aleo Network

Privacy-Centric Version of Circle's USDC Stablecoin Rolling Out via Aleo NetworkA new privacy-focused stablecoin powered by Circle's xReserve platform is launching on the testnet of layer-1 blockchain, Aleo.

- NEW

PNC Bank launches Bitcoin trading for eligible clients via Coinbase integration

PNC Bank launches Bitcoin trading for eligible clients via Coinbase integrationThe move makes PNC the first major US bank to offer spot Bitcoin trading within its own digital platform, starting with private bank clients.

- NEW

Malaysia’s Crown Prince Launches $121M Crypto Treasury – Despite Bubble Fears

Malaysia’s Crown Prince Launches $121M Crypto Treasury – Despite Bubble FearsJohor’s Crown Prince has entered digital assets with RMJDT, a ringgit-backed stablecoin on Zetrix, and a $121M–$242M treasury plan as Malaysia has expanded its crypto treasuries and regulation even while global digital-asset inflows have slowed and some treasury-focused stocks have lagged, recently. The post Malaysia’s Crown Prince Launches $121M Crypto Treasury – Despite Bubble Fears appeared first on Cryptonews.

OpenAI and Partners Launch the Agentic AI Foundation for Open-Source AI Development

OpenAI and Partners Launch the Agentic AI Foundation for Open-Source AI DevelopmentOpenAI, Anthropic, and Block, supported by tech giants, establish the Agentic AI Foundation under the Linux Foundation to advance open-source agentic AI infrastructure. (Read More)

OpenAI and Partners Launch the Agentic AI Foundation for Open-Source AI Development

OpenAI and Partners Launch the Agentic AI Foundation for Open-Source AI DevelopmentOpenAI, Anthropic, and Block, supported by tech giants, establish the Agentic AI Foundation under the Linux Foundation to advance open-source agentic AI infrastructure. (Read More)

Baltex Launches BTC to XMR Private Swaps

Baltex Launches BTC to XMR Private SwapsJacó, Costa Rica, 9th December 2025, Chainwire

Swapper Finance Launches Card Deposits to DeFi via Mastercard

Swapper Finance Launches Card Deposits to DeFi via MastercardThe new feature lets users fund DeFi protocols directly with bank cards.

Swapper Finance Launches Card Deposits to DeFi via Mastercard

Swapper Finance Launches Card Deposits to DeFi via MastercardThe new feature lets users fund DeFi protocols directly with bank cards.

OpenAI launches first certification courses focused on practical AI skills

OpenAI launches first certification courses focused on practical AI skillsOpenAI launches its first certification courses focused on practical AI skills for workers and teachers through ChatGPT and Coursera. The post OpenAI launches first certification courses focused on practical AI skills appeared first on Crypto Briefing.

Fact Check: Has JioCoin Officially Launched on the Polygon Network?

Fact Check: Has JioCoin Officially Launched on the Polygon Network?The post Fact Check: Has JioCoin Officially Launched on the Polygon Network? appeared first on Coinpedia Fintech News In early January 2025, Polygon Labs announced a partnership with Reliance Jio, India’s largest telecom company. The company said Jio would...

Shiba Inu’s Volume Explosion: Leading Meme Coin Barrels Ahead In This Metric

Shiba Inu’s Volume Explosion: Leading Meme Coin Barrels Ahead In This MetricShiba Inu has recorded a notable surge in spot trading activity on several exchanges over the last seven days. This provides a bullish outlook for the second-largest meme coin by market cap, which has been one of the underperformers in this market cycle. Shiba Inu Sees Surge In Spot Trading Activity CoinGlass data show a 154% surge in Shiba Inu USD spot trading volume on Kraken over the last seven days. There has also been a significant surge on other major exchanges, such as Binance, Bybit, OKX, and Gemini, during the same period. This indicates that spot buyers may be stepping in to defend the SHIB price at a critical support amid the broader crypto market decline. Related Reading: Will A Shiba Inu ETF Follow After Dogecoin? The Lone SHIB Filing Standing Against The Crowd Notably, Shiba Inu is one of the altcoins that are in the green over the last week, suggesting that the bulls may be in control at the moment. CoinMarketCap data shows that the second-largest meme coin by market cap is up almost 7% during this period despite Bitcoin’s choppy price action. Meanwhile, further data from CoinGlass also shows that most leverage traders are currently betting on an increase in the Shiba Inu price, with the long/short ratio currently above 1. However, it is worth noting that derivatives volume is down by over 10% and open interest is down by almost 4%, which presents a bearish outlook for the meme coin. Another positive for Shiba Inu, besides the surge in spot trading volume, is that the Fed is likely to cut interest rates again at this week’s FOMC meeting. This could inject more liquidity into the crypto market, with altcoins like SHIB benefiting from it. Meanwhile, Bitcoin is currently looking to hold above the psychological $90,000 level, which could pave the way for higher prices for SHIB given their positive correlation. Community Gives Update On SHIB’s Progress In an X post, Shiba Inu community member Shibizens gave an update on SHIB’s progress over the last few days. The community member noted that over 45 billion SHIB have been moved off exchanges, indicating that holders are accumulating. Shibizens also alluded to a $35 million whale transfer into a private wallet, suggesting that SHIB whales are also bullish. Related Reading: Will The Shiba Inu Price Hit A New All-Time High In 2025? Machine Learning Algorithm Answers Furthermore, Coinbase is set to launch Shiba Inu futures on December 12 for institutional and retail investors, which could boost the meme coin’s adoption. Meanwhile, NYSE Arca has filed the 19b-4 for T. Rowe’s Shiba Inu ETF, bringing the ETF one step closer to launch. Shibuzens also highlighted upgrades on the Shibarium network, which could provide a major boost for SHIB. This includes the RPC upgrade, while a full privacy upgrade has been confirmed using encrypted tech. There are plans to roll this out by next year. At the time of writing, the Shiba Inu price is trading at around $0.000008498, up in the last 24 hours, according to data from CoinMarketCap. Featured image from Peakpx, chart from Tradingview.com

Hong Kong Targets Crypto Tax Evasion with 2028 Data Sharing Plan

Hong Kong Targets Crypto Tax Evasion with 2028 Data Sharing PlanHong Kong launched a public consultation on implementing the OECD’s Crypto-Asset Reporting Framework (CARF) and amended Common Reporting Standard (CRS), aiming to begin automatic exchange of crypto tax information with partner jurisdictions by 2028. The government plans to complete legislative amendments in 2026, strengthening the city’s commitment to international tax cooperation while maintaining its reputation […] The post Hong Kong Targets Crypto Tax Evasion with 2028 Data Sharing Plan appeared first on Cryptonews.

Mistral Launches Devstral 2 and Vibe CLI for Advanced Coding Solutions

Mistral Launches Devstral 2 and Vibe CLI for Advanced Coding SolutionsMistral introduces Devstral 2 and Vibe CLI, offering state-of-the-art open-source coding models and terminal AI, enhancing code automation and efficiency. (Read More)

Avail Nexus Launches to Address Web3 Fragmentation Challenges

Avail Nexus Launches to Address Web3 Fragmentation ChallengesAvail Nexus introduces a new coordination layer to unify fragmented blockchain environments, enabling seamless many-to-many interactions. It simplifies user interactions by consolidating transactions into a single intent, enhancing technological freedom and economic scalability. This marks a significant step in...

Bitfinex-Backed Stable Sees Hectic Mainnet Launch as Token Price Drops

Bitfinex-Backed Stable Sees Hectic Mainnet Launch as Token Price DropsEarly supporters report they’re stuck unable to withdraw funds while STABLE loses value.

Mistral Launches Devstral 2 and Vibe CLI for Advanced Coding Solutions

Mistral Launches Devstral 2 and Vibe CLI for Advanced Coding SolutionsMistral introduces Devstral 2 and Vibe CLI, offering state-of-the-art open-source coding models and terminal AI, enhancing code automation and efficiency. (Read More)

Bitfinex-Backed Stable Sees Hectic Mainnet Launch as Token Price Drops

Bitfinex-Backed Stable Sees Hectic Mainnet Launch as Token Price DropsEarly supporters report they’re stuck unable to withdraw funds while STABLE loses value.

PNC Bank’s Landmark Move: Direct Bitcoin Trading Opens New Era for Mainstream Crypto Adoption

PNC Bank’s Landmark Move: Direct Bitcoin Trading Opens New Era for Mainstream Crypto AdoptionPNC Bank launches direct Bitcoin trading, marking a significant milestone for mainstream crypto adoption in the U.S. banking sector. Explore the implications. The post PNC Bank’s Landmark Move: Direct Bitcoin Trading Opens New Era for Mainstream Crypto Adoption appeared...

OpenAI Introduces AI Certification Courses to Enhance Workforce Skills

OpenAI Introduces AI Certification Courses to Enhance Workforce SkillsOpenAI launches AI Foundations and ChatGPT Foundations for Teachers to boost AI skills and career opportunities, aiming to certify 10 million Americans by 2030. (Read More)

PNC Bank Becomes First Major U.S. Bank to Offer Direct Bitcoin Trading

PNC Bank Becomes First Major U.S. Bank to Offer Direct Bitcoin TradingPNC Bank has officially launched direct spot Bitcoin trading for eligible clients, becoming the first major U.S. bank to offer native BTC trading on its digital platform.Visit Website

Crypto Wallet Firm Exodus Bets on Stablecoins for Real-World Payments With 2026 App

Crypto Wallet Firm Exodus Bets on Stablecoins for Real-World Payments With 2026 AppThe company launched Exodus Pay, which aims to remove crypto friction by letting users send, spend, and earn with stablecoins from one app.

Jack Maller’s Twenty One Capital debuts on NYSE

Jack Maller’s Twenty One Capital debuts on NYSETwenty One Capital launched on the NYSE with strong institutional backing and a massive Bitcoin treasury.

OpenAI Introduces AI Certification Courses to Enhance Workforce Skills

OpenAI Introduces AI Certification Courses to Enhance Workforce SkillsOpenAI launches AI Foundations and ChatGPT Foundations for Teachers to boost AI skills and career opportunities, aiming to certify 10 million Americans by 2030. (Read More)

Jack Maller’s Twenty One Capital debuts on NYSE

Jack Maller’s Twenty One Capital debuts on NYSETwenty One Capital launched on the NYSE with strong institutional backing and a massive Bitcoin treasury.

Exodus introduces Exodus Pay for seamless fiat and crypto payments

Exodus introduces Exodus Pay for seamless fiat and crypto paymentsExodus Pay launch for seamless self-custody fiat and crypto payments lets users blend digital assets and fiat for everyday transactions. The post Exodus introduces Exodus Pay for seamless fiat and crypto payments appeared first on Crypto Briefing.

Aleo launches USDC-backed USDCx stablecoin on testnet for privacy-first blockchain

Aleo launches USDC-backed USDCx stablecoin on testnet for privacy-first blockchainAleo's USDCx testnet launch could revolutionize digital transactions by enhancing privacy and interoperability in blockchain ecosystems. The post Aleo launches USDC-backed USDCx stablecoin on testnet for privacy-first blockchain appeared first on Crypto Briefing.

Johor Crown Prince Launches Malaysia’s RMJDT Stablecoin

Johor Crown Prince Launches Malaysia’s RMJDT StablecoinTunku Ismail Ibni Sultan Ibrahim, the crown prince of Johor, introduced a new stablecoin, RMJDT, pegged to the Malaysian ringgit, on December 8.

- Kyrgyzstan Launches $50M Gold-backed USDKG Stablecoin to Modernize Cross-border Payments

Kyrgyzstan has officially launched USDKG, a gold-backed stablecoin pegged 1:1 to the U.S. dollar, with an initial issue of $50 million. The token is issued on Tron and fully audited by ConsenSys Diligence, with future expansion slated to include Ethereum support. The issuer, OJSC Virtual Asset Issuer, is a state-owned entity under the Ministry of The post Kyrgyzstan Launches $50M Gold-backed USDKG Stablecoin to Modernize Cross-border Payments appeared first on BeInCrypto.

- ADI Chain Debuts Mainnet and $ADI Token, Marking MENA’s First Institutional Layer-2 Network

Abu Dhabi-based network launches mainnet with $ADI token, 50+ projects in the pipeline for deployment, and infrastructure ready to host dirham-backed stablecoin  Today, the ADI Foundation announced the mainnet launch of ADI Chain, the first institutional L2 blockchain for stablecoins and real-world assets in the MENA region. The $ADI token launches simultaneously on Kraken, Crypto.com, The post ADI Chain Debuts Mainnet and $ADI Token, Marking MENA’s First Institutional Layer-2 Network appeared first on BeInCrypto.

XRP Secures $1B AUM Milestone, Sets ETF Speed Record In The US

XRP Secures $1B AUM Milestone, Sets ETF Speed Record In The USXRP Spot ETFs have nearly crossed the $1 billion mark in assets under management (AUM), marking one of the quickest ramps since Ethereum, according to Ripple’s CEO. Related Reading: All-In On XRP: Why This Leading Investor Sold His Entire Bitcoin Stack Rapid Fund Growth In Weeks According to the disclosure, the four XRP ETF products now hold about $1.23B in total net assets, which equals 597 million XRP at a reported XRP price of $2.06. Reports have disclosed a fresh inflow of $30 million on Monday, Dec. 8, and the cumulative net inflow into these products stands close to $935 million. Ripple CEO Brad Garlinghouse highlighted that the collective figure reached the $1 billion level in under four weeks after the first fund hit the market. Canary Capital Leads With Heavy Flows Canary Capital’s XRPC grabbed the most attention at launch, bringing roughly $245 million in net flows on its debut day on Nov. 13. Canary’s fund holds about 335.889 million XRP, valued at approximately $691 million, which represents 56% of the combined assets across the four funds. 👀<4 weeks, and XRP is now the fastest crypto Spot ETF to reach $1B in AUM (since ETH) in the US. With over 40 crypto ETFs launched this year in the US alone, a few points are obvious to me: 1/ there’s pent up demand for regulated crypto products, and with Vanguard opening up… — Brad Garlinghouse (@bgarlinghouse) December 8, 2025 The other managers hold smaller shares: Grayscale’s product holds 104.381 million XRP, about $215 million or 17.47% of the total; Bitwise carries 93.827 million XRP valued at $193.284 million or 15.7%; Franklin Templeton has 62.99 million XRP worth about $131.829 million, or 10.71%. A Wave Of Approved Crypto Funds Based on reports, this development follows a broader rollout of spot and futures crypto ETFs since US spot Bitcoin ETFs arrived in January 2024. Ethereum spot products launched in July 2024, and Solana listings came in October 2025. The US Securities and Exchange Commission has approved more than 40 crypto-related ETF products this year, which market participants say has opened familiar rails for mainstream investors. Vanguard’s choice to allow crypto access inside standard retirement and broker accounts is being cited as a change that lets many Americans gain exposure without deep crypto know-how. What This Means For Investors According to analysts and market observers, the speed of these flows underlines strong demand for regulated crypto vehicles. Big-name asset managers entering the market have helped create options that look and act like other mutual funds or ETFs, which can ease the path for retirement plans and advisers to take part. At the same time, a large share resting in a single debut fund shows concentration risk: Canary’s XRPC accounts for more than half of the total net assets, and that matters for liquidity and fund dynamics if flows shift. Related Reading: Banking Meets Bitcoin: French Banking Giant Offers Crypto To Millions Fresh Inflows & ETF Demand While $1.23 billion is a headline figure, market watchers will be watching fresh inflows, trading volumes, and how price moves react to ETF demand. For now, XRP listings have drawn sizable attention, and the coming weeks should make clearer whether the early momentum will spread more evenly across products and push broader investor participation. Featured image from Unsplash, chart from TradingView

- BitMEX Integrates Mercuryo On-ramp to Introduce Fiat-to-Crypto Conversion

[Victoria, Seychelles, 9 December 2025] BitMEX, one of the safest crypto exchanges, announced today the launch of fiat-to-crypto on-ramps on its platform through a partnership with Mercuryo, a global payment infrastructure platform. The introduction of this feature will enable users on the exchange to purchase cryptocurrency using a variety of fiat currencies. The availability of The post BitMEX Integrates Mercuryo On-ramp to Introduce Fiat-to-Crypto Conversion appeared first on BeInCrypto.

Malaysia’s crown prince launches ringgit stablecoin, Zetrix treasury

Malaysia’s crown prince launches ringgit stablecoin, Zetrix treasuryMalaysia’s crown prince launches a stablecoin on Zetrix and a $121 million digital asset treasury modeled after MicroStrategy despite sector bubble fears.

Malaysia’s crown prince launches ringgit stablecoin, Zetrix treasury

Malaysia’s crown prince launches ringgit stablecoin, Zetrix treasuryMalaysia’s crown prince launched a stablecoin on Zetrix and a $121 million digital asset treasury modeled after MicroStrategy, despite sector bubble fears.

Aleo Integrates with Circle xReserve to Launch USDCx Stablecoin on Testnet

Aleo Integrates with Circle xReserve to Launch USDCx Stablecoin on TestnetAleo introduces USDCx, a USDC-backed stablecoin, on its Testnet, utilizing Circle xReserve for secure issuance and cross-chain transfers. This development supports private, compliant applications in various sectors, including global payroll and DeFi, leveraging Aleo's zero-knowledge architecture for enhanced privacy....

Bullish Aim Introduces RMJDT to Power Malaysia’s Digital Economy

Bullish Aim Introduces RMJDT to Power Malaysia’s Digital EconomyKey Highlights: Bullish Aim announces launch of stablecoin RMJDT, backed by Malaysian ringgit (MYR) and short-term government bonds.…

Hong Kong begins talks for 2028 implementation of crypto tax data sharing

Hong Kong begins talks for 2028 implementation of crypto tax data sharingHong Kong has started a public consultation on the implementation of the Crypto-Asset Reporting Framework (CARF) and amendments to the Common Reporting Standard (CRS). The review, launched by the government, outlines how the city plans to begin automatically exchanging...

Hong Kong launches CARF crypto tax consultation to combat evasion

Hong Kong launches CARF crypto tax consultation to combat evasionHong Kong has launched a public consultation on adopting the OECD’s crypto account tax data sharing program, CARF, and revising its tax reporting standards.

Hong Kong launches CARF crypto tax consultation to combat evasion

Hong Kong launches CARF crypto tax consultation to combat evasionHong Kong has launched a public consultation on adopting the OECD’s crypto account tax data sharing program, CARF, and revising its tax reporting standards.

- Horizen Launches Mainnet on Base

With deep roots in onchain privacy, Horizen has successfully migrated to Ethereum as a Layer-3 blockchain on Base for privacy-enabled and regulatory-ready applications. Horizen has officially launched its mainnet as an EVM-native rollup on Base, marking its full transition from an independent proof-of-work blockchain to a privacy application-focused chain within the Ethereum ecosystem. The move The post Horizen Launches Mainnet on Base appeared first on BeInCrypto.

Dogecoin ETFs lose their bite as Bitcoin, Ethereum big dogs lead the pack

Dogecoin ETFs lose their bite as Bitcoin, Ethereum big dogs lead the packThe total value traded for spot DOGE ETFs reached its lowest point since launch, signaling a fading of the early hype as liquidity and flows lag well behind those of major crypto ETFs.

Hong Kong Moves to Track Crypto Taxes Globally

Hong Kong Moves to Track Crypto Taxes GloballyThe post Hong Kong Moves to Track Crypto Taxes Globally appeared first on Coinpedia Fintech News Hong Kong has launched a public consultation to update its Crypto Asset Reporting Framework (CARF) and the Common Reporting Standard (CRS). The plan...

Tassat Wins U.S. Patent for 'Yield-in-Transit' Onchain Settlement Tech

Tassat Wins U.S. Patent for 'Yield-in-Transit' Onchain Settlement TechThe IP covers intraday, block-by-block interest accrual during 24/7 settlement and underpins Lynq, an institutional network Tassat co-launched in July.

CFTC Greenlights Tokenized Collateral Pilot: Bitcoin, Ethereum, USDC to Reshape Derivatives Markets

CFTC Greenlights Tokenized Collateral Pilot: Bitcoin, Ethereum, USDC to Reshape Derivatives MarketsThe CFTC launches a pilot program for tokenized collateral in derivatives markets, utilizing Bitcoin, Ethereum, and USDC to enhance efficiency and transparency. The post CFTC Greenlights Tokenized Collateral Pilot: Bitcoin, Ethereum, USDC to Reshape Derivatives Markets appeared first on...

Cronos Labs Announces Launch Of Cronos One, A Unified Gateway for Seamless and Verified Web3 Onboarding

Cronos Labs Announces Launch Of Cronos One, A Unified Gateway for Seamless and Verified Web3 OnboardingToday, Cronos Labs unveiled Cronos One, a centralized onboarding platform that streamlines the process for new and cross-chain users to join the Cronos ecosystem. For the upcoming generation of Web3 users, the platform unifies wallet top-ups, bridging, and on-chain...

Cronos Labs Announces Launch Of Cronos One, A Unified Gateway for Seamless and Verified Web3 Onboarding

Cronos Labs Announces Launch Of Cronos One, A Unified Gateway for Seamless and Verified Web3 OnboardingToday, Cronos Labs unveiled Cronos One, a centralized onboarding platform that streamlines the process for new and cross-chain users to join the Cronos ecosystem. For the upcoming generation of Web3 users, the platform unifies wallet top-ups, bridging, and on-chain identity verification into a single, seamless experience. Cronos Verify, a gasless and private on-chain attestation that […]

Robinhood Unlocks Ethereum & Solana Staking: A New Era for Retail Crypto Yield

Robinhood Unlocks Ethereum & Solana Staking: A New Era for Retail Crypto YieldRobinhood launches ETH & SOL staking, allowing retail investors to earn yield directly. A game-changer for crypto adoption and passive income. The post Robinhood Unlocks Ethereum & Solana Staking: A New Era for Retail Crypto Yield appeared first on...

Standard Chartered-Backed Libeara Launches Tokenized Gold Fund in Singapore

Standard Chartered-Backed Libeara Launches Tokenized Gold Fund in SingaporeLibeara, the blockchain infrastructure platform backed by Standard Chartered’s venture arm SC Ventures, has rolled out a tokenized gold investment fund. The post Standard Chartered-Backed Libeara Launches Tokenized Gold Fund in Singapore appeared first on Cryptonews.

A Christmas gift for global users: Loyal Miner offers free cloud computing power, start earning instantly

A Christmas gift for global users: Loyal Miner offers free cloud computing power, start earning instantlyLoyal Miner has launched its Christmas event, giving new users free cloud computing power to start earning mining rewards right away. #partnercontent

FORT Miner releases Smart Mining 3.0 technology, upgrading passive income from crypto

FORT Miner releases Smart Mining 3.0 technology, upgrading passive income from cryptoFORT Miner has launched a mobile-first cloud mining platform that lets users activate mining contracts and earn daily rewards without hardware or technical setup. #partnercontent

CFTC Launches Digital Assets Program for Tokenized Crypto Collateral in Derivatives

CFTC Launches Digital Assets Program for Tokenized Crypto Collateral in DerivativesThe US Commodity Futures Trading Commission (CFTC) is preparing for the trading of tokenized real-world assets (RWA) and allowing crypto collateral for derivatives.

Cronos (CRO) One Launches to Enhance Web3 Onboarding and Verification

Cronos (CRO) One Launches to Enhance Web3 Onboarding and VerificationCronos (CRO) One introduces a streamlined onboarding hub for Web3 users, facilitating wallet setup and verification while enhancing DeFi accessibility and trust. (Read More)

Cronos (CRO) One Launches to Enhance Web3 Onboarding and Verification

Cronos (CRO) One Launches to Enhance Web3 Onboarding and VerificationCronos (CRO) One introduces a streamlined onboarding hub for Web3 users, facilitating wallet setup and verification while enhancing DeFi accessibility and trust. (Read More)

Moca Network Launches MocaProof Beta, the Digital Identity Verification and Reward Platform

Moca Network Launches MocaProof Beta, the Digital Identity Verification and Reward PlatformHong Kong, China, 8th December 2025, Chainwire

Cronos Launches Cronos One: A Unified Hub for Enhanced User Experience

Cronos Launches Cronos One: A Unified Hub for Enhanced User ExperienceCronos has launched Cronos One, a platform to streamline user onboarding with features like bridging, wallet top-ups, and on-chain verification. It integrates AI tools for DeFi navigation and supports identity-aware dApps, offering benefits such as gasless transactions and zero...

Hong Kong Boosts Its Crypto Stance with HashKey’s Ambitious IPO Launch

Hong Kong Boosts Its Crypto Stance with HashKey’s Ambitious IPO LaunchHong Kong strengthens its crypto leadership with HashKey's major IPO. HashKey plans to raise $215 million, backed by UBS and Fidelity. Continue Reading:Hong Kong Boosts Its Crypto Stance with HashKey’s Ambitious IPO Launch The post Hong Kong Boosts Its...

Superform Bridges TradFi and DeFi: New Stablecoin Neobank Products Offer Institutional Yield to Everyday Users

Superform Bridges TradFi and DeFi: New Stablecoin Neobank Products Offer Institutional Yield to Everyday UsersSuperform launches innovative stablecoin neobank products, offering everyday users access to institutional-grade yield. Bridging TradFi and DeFi for mass adoption. The post Superform Bridges TradFi and DeFi: New Stablecoin Neobank Products Offer Institutional Yield to Everyday Users appeared first...

XRP Reaches $1,000,000,000 Milestone in No Time: Ripple CEO

XRP Reaches $1,000,000,000 Milestone in No Time: Ripple CEOThe Ripple CEO recently disclosed that the XRP ETF products have hit the $1 billion AuM milestone, making it the fastest to reach this milestone since Ethereum. Following the launch of the spot Bitcoin ETFs in January 2024, which...

HashKey launches Hong Kong IPO with $215M targeted raise

HashKey launches Hong Kong IPO with $215M targeted raiseHashKey has opened subscriptions for its Hong Kong initial public offering, targeting up to $215M with backing from UBS and Fidelity in a key moment for the city’s crypto ambitions. The exchange operator is seeking to raise as much as…

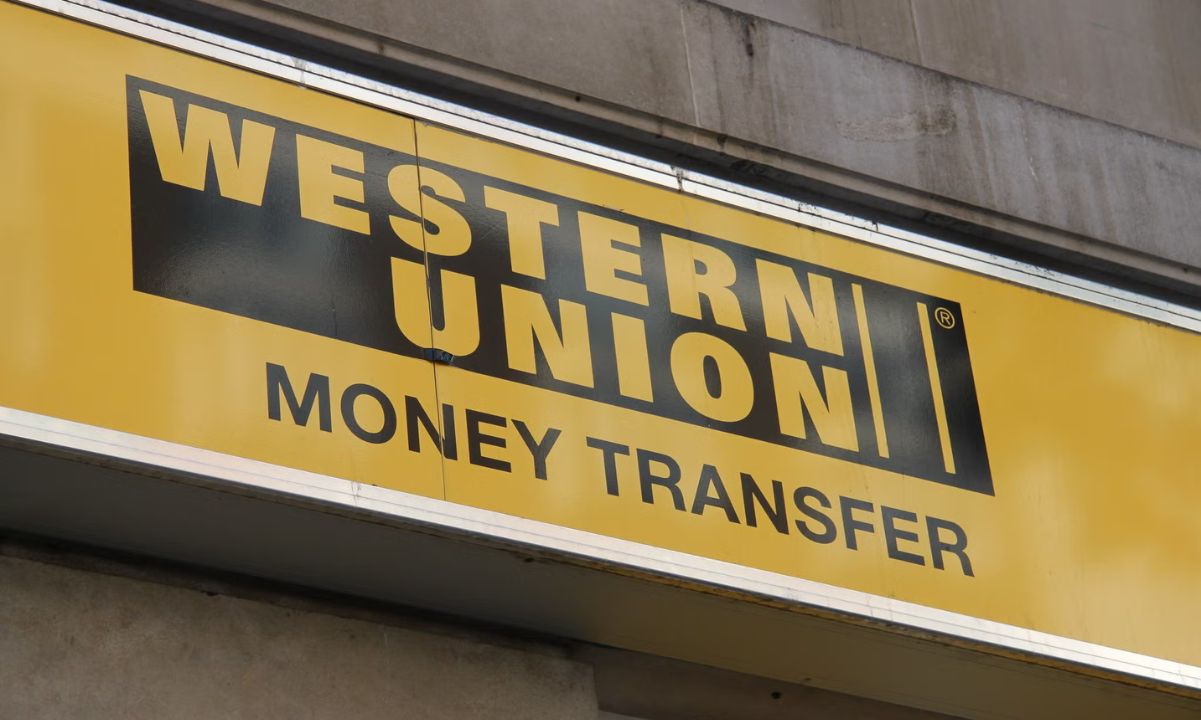

Western Union Targets High-Inflation Markets With ‘Stable Card’

Western Union Targets High-Inflation Markets With ‘Stable Card’Payments giant Western Union is launching a “stable card” aimed at users in countries suffering from high inflation.

MegaETH to launch Frontier mainnet beta for developers next week

MegaETH to launch Frontier mainnet beta for developers next weekMegaETH is moving into a new phase of development with a planned launch of its Frontier mainnet beta to builders. MegaETH is preparing to open its mainnet beta, known as Frontier, to developers next week. A Dec. 8 update on…

Coinbase Forges Landmark Bridge Between Base and Solana: A New Era for Cross-Chain Liquidity

Coinbase Forges Landmark Bridge Between Base and Solana: A New Era for Cross-Chain LiquidityCoinbase launches a bridge between its Base L2 and Solana, marking a new era for cross-chain liquidity and dApp integration. Explore the market impact. The post Coinbase Forges Landmark Bridge Between Base and Solana: A New Era for Cross-Chain...

Western Union Targets High-Inflation Markets With ‘Stable Card’

Western Union Targets High-Inflation Markets With ‘Stable Card’Payments giant Western Union is launching a “stable card” aimed at users in countries suffering from high inflation.

U.S. CFTC launches pilot for tokenized derivatives collateral

U.S. CFTC launches pilot for tokenized derivatives collateralThe Commodity Futures Trading Commission has opened the door for tokenized assets to be used across U.S. derivatives markets. The commission has launched a digital assets pilot program covering Bitcoin, Ethereum, USDC, and tokenized real-world assets. In its Dec .…

UAE’s Ruya Bank Pioneers Shari’ah-Compliant In-App Bitcoin Trading, Unlocking New Markets

UAE’s Ruya Bank Pioneers Shari’ah-Compliant In-App Bitcoin Trading, Unlocking New MarketsRuya Bank in UAE launches Shari'ah-compliant in-app Bitcoin trading, a first for Islamic finance. Expands crypto adoption & legitimizes digital assets for Muslim investors. The post UAE’s Ruya Bank Pioneers Shari’ah-Compliant In-App Bitcoin Trading, Unlocking New Markets appeared first...

- CFTC Greenlights Bitcoin, Ether as Derivatives Collateral in Landmark Pilot Program

The US Commodity Futures Trading Commission (CFTC) launched a digital assets pilot program on December 8, permitting bitcoin, ether, and USDC as margin collateral in derivatives markets—a move industry leaders are calling a watershed moment for crypto adoption. Acting...

Helix launches 24/5 real-time equity pricing for major equities

Helix launches 24/5 real-time equity pricing for major equitiesHelix's 24/5 equity pricing could revolutionize after-hours trading, enhancing market efficiency and accessibility for global investors. The post Helix launches 24/5 real-time equity pricing for major equities appeared first on Crypto Briefing.

CFTC Rolls Out Digital Assets Pilot Program for Tokenized Collateral

CFTC Rolls Out Digital Assets Pilot Program for Tokenized CollateralKey Highlights The U.S. CFTC has announced the launch of a pilot program, which allows major firms to…

Sonami Unveils Groundbreaking Layer 2 Solution on Solana to Tackle Network Congestion

Sonami Unveils Groundbreaking Layer 2 Solution on Solana to Tackle Network CongestionSonami launches the first Layer 2 token on Solana, promising enhanced transaction efficiency and an end to network congestion spikes. The post Sonami Unveils Groundbreaking Layer 2 Solution on Solana to Tackle Network Congestion appeared first on FXcrypto News.

CFTC launches digital assets pilot, allowing Bitcoin and Ethereum as collateral

CFTC launches digital assets pilot, allowing Bitcoin and Ethereum as collateralThe CFTC launched a digital asset pilot allowing BTC, ETH, and USDC as derivatives collateral under the GENIUS Act. The post CFTC launches digital assets pilot, allowing Bitcoin and Ethereum as collateral appeared first on Crypto Briefing.

Spectra Launches on Flare With Yield Tokenization for sFLR and stXRP

Spectra Launches on Flare With Yield Tokenization for sFLR and stXRPYield trading platform, Spectra, has introduced yield tokenization that splits interest‑bearing tokens into principal tokens and yield tokens. Principal tokens guarantee fixed returns at maturity, while yield tokens allow speculation or hedging on future yield rates. Benefits for Users...

CFTC Launches Digital Assets Pilot Allowing Bitcoin, Ether and USDC as Collateral

CFTC Launches Digital Assets Pilot Allowing Bitcoin, Ether and USDC as CollateralActing Chair Caroline Pham has unveiled a first-of-its-kind U.S. program to permit tokenized collateral in derivatives markets, citing "clear guardrails" for firms.

CFTC Launches Pilot Program Allowing Bitcoin To Be Used as Collateral In Derivatives Markets

CFTC Launches Pilot Program Allowing Bitcoin To Be Used as Collateral In Derivatives MarketsBitcoin Magazine CFTC Launches Pilot Program Allowing Bitcoin To Be Used as Collateral In Derivatives Markets The CFTC launched a U.S. pilot program allowing Bitcoin to be used as collateral in regulated derivatives markets. This post CFTC Launches Pilot Program Allowing Bitcoin To Be Used as Collateral In Derivatives Markets first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

CFTC launches digital assets pilot, allowing Bitcoin and Ethereum as collateral

CFTC launches digital assets pilot, allowing Bitcoin and Ethereum as collateralThe CFTC launched a digital asset pilot allowing BTC, ETH, and USDC as derivatives collateral under the GENIUS Act. The post CFTC launches digital assets pilot, allowing Bitcoin and Ethereum as collateral appeared first on Crypto Briefing.

HTX Affiliate HBGL Marks Australia Soft Launch: Pioneering Compliant Fiat-Stablecoin Services Down Under

HTX Affiliate HBGL Marks Australia Soft Launch: Pioneering Compliant Fiat-Stablecoin Services Down UnderHTX affiliate HBGL launches compliant fiat-stablecoin services in Australia, bolstering regulated crypto options & market trust in a key financial hub. The post HTX Affiliate HBGL Marks Australia Soft Launch: Pioneering Compliant Fiat-Stablecoin Services Down Under appeared first on...

Hyperliquid Launches Direct USDC Transfers

Hyperliquid Launches Direct USDC TransfersThe update unifies USDC across HyperCore and HyperEVM, setting up a transition away from the Arbitrum-based bridge.

BlackRock Seeks SEC Nod To Launch Staked Ethereum ETF

BlackRock Seeks SEC Nod To Launch Staked Ethereum ETFBlackRock has officially applied to list and trade shares of an investment vehicle tied to a staked Ethereum exchange-traded fund (ETF).

Hyperliquid Launches Direct USDC Transfers

Hyperliquid Launches Direct USDC TransfersThe update unifies USDC across HyperCore and HyperEVM, setting up a transition away from the Arbitrum-based bridge.

BlackRock Seeks SEC Nod To Launch Staked Ethereum ETF

BlackRock Seeks SEC Nod To Launch Staked Ethereum ETFBlackRock has officially applied to list and trade shares of an investment vehicle tied to a staked Ethereum exchange-traded fund (ETF).

Binance Suspends Employee Over Insider Trading Scandal Involving Meme Token

Binance Suspends Employee Over Insider Trading Scandal Involving Meme TokenBinance, the world's largest cryptocurrency exchange, has suspended an employee and launched legal proceedings after discovering insider trading related to a newly created meme token. The incident highlights ongoing challenges with internal controls at major crypto exchanges.

StableChain launches mainnet with USDT gas fees, dedicated governance token

StableChain launches mainnet with USDT gas fees, dedicated governance tokenThe USDT-powered network launches with support from Bitfinex, Hack VC, Tether executives and other investors following a $28 million seed round.

Binance Suspends Employee That Used Official X Account to Promote BNB Chain Token

Binance Suspends Employee That Used Official X Account to Promote BNB Chain TokenCrypto exchange Binance has disciplined an employee after they used a brand account to promote the launch of a meme coin they helped create.

SemiLiquid Introduces Programmable Credit Protocol To Transform Institutional Lending On Tokenized Assets

SemiLiquid Introduces Programmable Credit Protocol To Transform Institutional Lending On Tokenized AssetsSemiLiquid today announced the global debut of its Programmable Credit Protocol (PCP). This custody-native credit infrastructure enables institutions to unlock credit directly against digital and tokenized assets, without transferring collateral out of custody. The launch took place at Abu...

Binance Suspends Employee That Used Official X Account to Promote BNB Chain Token

Binance Suspends Employee That Used Official X Account to Promote BNB Chain TokenCrypto exchange Binance has disciplined an employee after they used a brand account to promote the launch of a meme coin they helped create.

SemiLiquid Introduces Programmable Credit Protocol To Transform Institutional Lending On Tokenized Assets

SemiLiquid Introduces Programmable Credit Protocol To Transform Institutional Lending On Tokenized AssetsSemiLiquid today announced the global debut of its Programmable Credit Protocol (PCP). This custody-native credit infrastructure enables institutions to unlock credit directly against digital and tokenized assets, without transferring collateral out of custody. The launch took place at Abu Dhabi Finance Week 2025, signaling a major leap forward for the evolving digital capital markets ecosystem. […]

StableChain Mainnet Launches with $STABLE Token

StableChain Mainnet Launches with $STABLE TokenBitfinex-backed StableChain goes live as a USDT-native Layer 1 for payments.

Bitcoin ETF Giant BlackRock Files to Launch Ethereum Staking ETF

Bitcoin ETF Giant BlackRock Files to Launch Ethereum Staking ETFInvestment firm BlackRock filed the S-1 registration statement for a new Ethereum staking ETF, ETHB, separate from its existing ETHA fund.

Sonami Launches First Layer 2 Token on Solana to Ensure Transaction Efficiency and End Congestion Spikes

Sonami Launches First Layer 2 Token on Solana to Ensure Transaction Efficiency and End Congestion SpikesNew York, United States, 8th December 2025, Chainwire

HumidiFi to Launch New Token After Snipers Raid Presale

HumidiFi to Launch New Token After Snipers Raid PresaleThe proprietary AMM on Solana had its public token sale filled in seconds as botters stormed in to take the entire supply.

21Shares Launches First Leveraged Sui ETF on Nasdaq

21Shares Launches First Leveraged Sui ETF on NasdaqThe new fund, TXXS, gives traders 2x daily exposure to SUI.

BlackRock is RISK On! Polymarket launches US App! Crypto still Green!

BlackRock is RISK On! Polymarket launches US App! Crypto still Green!Crypto majors traded slightly higher, with ETH leading gains post-Fusaka as BTC rose 1% to $93,000, ETH jumped 4% to $3,190, and BNB and SOL each added 1% to reach $909 and $143, respectively. Among top movers, ZEC (+10%), TAO (+8%), and DASH (+6%) outperformed. Large ETH holders resumed sizeable spot purchases following Monday’s liquidations, suggesting renewed institutional dip-buying. At the Dealbook Summit, Brian Armstrong noted that “top banks” are partnering with Coinbase on pilots for stablecoins, custody, and trading. BlackRock released its 2026 outlook with a risk-on tilt, maintaining an overweight position in U.S. equities and highlighting AI and rising stablecoin adoption as “megaforces” reshaping markets. Meanwhile, Binance introduced “Binance Junior,” a crypto savings account for minors with extensive parental oversight, and Startale—Sony’s Soneium blockchain partner—launched USDSC, a stablecoin set to serve as the default settlement asset on the Soneium L2.

MetaMask Launches Polymarket Integration

MetaMask Launches Polymarket IntegrationHowever, each trade via the web3 wallet comes with a 4% fee, unlike betting directly on Polymarket.

BlackRock stays risk-on into 2026, Binance Launches ‘Binance Junior’ for Kids, Kalshi Partners with CNN - Daily Crypto Recap

BlackRock stays risk-on into 2026, Binance Launches ‘Binance Junior’ for Kids, Kalshi Partners with CNN - Daily Crypto RecapDecrypt's daily crypto news recap with @tyler_did_it. Your crypto round-up for December 4th 2025

Ethereum Launches Fusaka Upgrade to Make Network More Scalable

Ethereum Launches Fusaka Upgrade to Make Network More ScalableThe upgrade introduces the PeerDAS system, helping Ethereum process more transactions while keeping fees low.

Crypto UP 7-10%, Bank of America recommends crypto, Kalshi raise $11B

Crypto UP 7-10%, Bank of America recommends crypto, Kalshi raise $11BCrypto majors are sharply higher, climbing 6–10% following Vanguard’s crypto debut and supportive commentary from Bank of America, with BTC up 6% to $92,900, ETH up 9% to $3,070, BNB up 7% to $899, and SOL up 10% to $142. Among top movers, SUI gained 24%, PENGU 19%, and LINK 18%. Ethereum’s Fusaka upgrade is scheduled to launch today, aiming to improve mainnet ingestion of L2 data and reduce rollup costs to enhance scalability. Bank of America is now recommending a 1–4% crypto allocation for clients across Merrill Lynch and the Private Bank. On the corporate front, Kraken has agreed to acquire tokenization platform Backed Finance to accelerate the adoption of tokenized stocks, while Chainlink introduced its “LINK Everything” initiative, a comprehensive tokenization stack featuring CCIP, compliance tools, and expanded data and compute services. In the regulatory and leadership landscape, crypto-friendly Kevin Hassett is now an 85% favorite to become the next Federal Reserve Chair after Jerome Powell, Binance has appointed cofounder He Yi as Co-CEO, and the UK has formally created a new property category for crypto and NFTs through its newly passed Property Act.

HYPE Jumps 8% After $888 Million DAT Gets Approved

HYPE Jumps 8% After $888 Million DAT Gets ApprovedSonnet BioTherapeutics will merge with Rorschach LLC to launch the first major HYPE treasury company.

Terminal Finance Shuts Down After Ethena’s Converge Chain Fails to Launch

Terminal Finance Shuts Down After Ethena’s Converge Chain Fails to LaunchThe shutdown comes after months of delays on Converge’s mainnet, leaving Terminal Finance without the ecosystem it was built for.

Ripple’s RLUSD Stablecoin Tops $1B on Ethereum

Ripple’s RLUSD Stablecoin Tops $1B on EthereumLess than a year after launching, Ripple’s RLUSD has crossed $1 billion in circulating supply, with most of its supply now on Ethereum.

Mt Pelerin launches the crypto IBAN

Mt Pelerin launches the crypto IBANPRNewswire, PRNewswire, 2nd December 2025, Chainwire

Trust Wallet Launches First In-Wallet Prediction Markets With Myriad

Trust Wallet Launches First In-Wallet Prediction Markets With MyriadPrediction markets represent a "new way of combining social expression with digital footprint and value," Trust Wallet CEO Eowyn Chen tells Decrypt, as they launch the first natively integrated in-wallet prediction markets with Myriad.

Over $650M Liquidated! China confirms Crypto Illegal! Infinex Interview!

Over $650M Liquidated! China confirms Crypto Illegal! Infinex Interview!Crypto majors slid sharply, reversing all of last week’s gains, with BTC down 6% to $85,800, ETH down 6% to $2,820, BNB falling 7% to $822, and SOL dropping 7% to $127. Among top movers, MYX (+15%) and JST (+4%) led the market. More than $650 million in positions were liquidated over the past day, including $580 million in longs after BTC dipped below $86,000. ZEC suffered the steepest decline among major tokens, falling 20% to $355 and 35% on the week. Meanwhile, Tether founder Paolo Ardoino again addressed the latest wave of Tether FUD, reiterating that the company is not at risk of insolvency. In regulatory developments, China’s central bank reaffirmed that crypto remains illegal and signaled a coming crackdown. Robinhood announced a partnership with Susquehanna to launch a new CFTC-licensed exchange, paving the way for a major expansion into prediction markets. Pavel Durov revealed Cocoon, a new decentralized confidential compute network where GPU operators earn TON rewards. JPMorgan also entered the spotlight with a new structured BTC-linked product that offers investors a minimum 16% yield—up to 50% depending on BTC’s performance—with downside protection of up to 30%.

Polymarket can now operate in US! Texas buys $5M BTC! MON up another 24%!

Polymarket can now operate in US! Texas buys $5M BTC! MON up another 24%!Crypto majors were slightly red, with BTC down 1% at $86,600 and ETH down 1% at $2,910, while BNB gained 1% to $856 and SOL held steady at $136. Among top movers, MON (+24%), SPX (+13%), and IP (+7%) led the market. In policy and institutional developments, Texas launched its Bitcoin reserve with a $5 million purchase of BlackRock’s IBIT ETF, marking the first deployment of its approved $10 million BTC budget. U.S. Bank completed a test of issuing a proprietary stablecoin on the Stellar network, and MoonPay secured a New York trust charter, joining firms like Coinbase and Ripple to expand institutional custody and service capabilities. Polymarket received CFTC approval to reenter the U.S., enabling it to onboard domestic users, brokers, and intermediaries, while Kalshi was blocked in Nevada from offering sports and election markets after a judge reversed an earlier ruling. Klarna introduced its own stablecoin, KlarnaUSD, on Tempo. Meanwhile, the Department of Homeland Security has reportedly been investigating Bitmain as a national security risk, examining whether the company can remotely access its equipment.

First US Spot DOGE ETF Sees $1.4M in Day-One Volumes

First US Spot DOGE ETF Sees $1.4M in Day-One VolumesGrayscale’s spot Dogecoin ETF fell short of expectations on its launch day.

Is the Bull Market over? The AI Manhattan Project! Monad Launch Reaction!

Is the Bull Market over? The AI Manhattan Project! Monad Launch Reaction!Crypto majors rallied alongside a broad market surge, with BTC up 2% to $87,400, ETH up 4% to $2,920, BNB up 1% to $850, and SOL up 5% to $136, while KAS (+22%), ENA (+13%), and SUI (+11%) led the day’s top movers. The NASDAQ jumped 2.7% as stocks such as GOOG (+6%) and TSLA (+7%) posted strong gains. In policy and industry developments, the White House launched the “Genesis Mission,” described as a Manhattan Project–style initiative for AI, and Binance along with CZ faced new accusations of enabling crypto transactions for Hamas. Kraken hinted at a debit card debut expected today, and Tether purchased another 1 million Rumble shares, pushing the YouTube rival’s stock sharply higher. Meanwhile, the European Central Bank reiterated its warnings that the rapid growth of stablecoins could introduce stability risks to the wider financial system.

SKALE Launches on Base in New Initiative for Onchain Agents

SKALE Launches on Base in New Initiative for Onchain AgentsSKALE taps Base’s liquidity and users, making cross-chain AI agent deployment easier.

Polymarket Receives CFTC Approval to Operate in the United States

Polymarket Receives CFTC Approval to Operate in the United StatesThe long-awaited Polymarket US has been cleared to launch.

Crypto is GREEN! MON launches at $3.9Billion FDV!

Crypto is GREEN! MON launches at $3.9Billion FDV!Crypto majors rallied alongside a broad market surge, with BTC up 2% to $87,400, ETH up 4% to $2,920, BNB up 1% to $850, and SOL up 5% to $136, while KAS (+22%), ENA (+13%), and SUI (+11%) led the day’s top movers. The NASDAQ jumped 2.7% as stocks such as GOOG (+6%) and TSLA (+7%) posted strong gains. In policy and industry developments, the White House launched the “Genesis Mission,” described as a Manhattan Project–style initiative for AI, and Binance along with CZ faced new accusations of enabling crypto transactions for Hamas. Kraken hinted at a debit card debut expected today, and Tether purchased another 1 million Rumble shares, pushing the YouTube rival’s stock sharply higher. Meanwhile, the European Central Bank reiterated its warnings that the rapid growth of stablecoins could introduce stability risks to the wider financial system.

Monad Launches Mainnet, MON Trades Near ICO Price

Monad Launches Mainnet, MON Trades Near ICO PriceMON briefly surged 14% higher than its ICO price after listing across major CEXs, before retracing.

Build on Bitcoin Token Rallies on Coinbase Listing

Build on Bitcoin Token Rallies on Coinbase ListingThe Bitcoin DeFi token is up 25% from its launch price.

Bitcoin Plummets 11%! Crypto in Free-Fall! Guests: OSF & Wizard Of SoHo

Bitcoin Plummets 11%! Crypto in Free-Fall! Guests: OSF & Wizard Of SoHoBtc: 81.6k (-11%) | btc.D: 58.8% (-0.5%). Eth: 2665 (-12%) | bnb: 800 (-11%) | sol: 123 (-13%). Bitcoin and Ethereum ETFs saw significant outflows, with broader crypto markets falling sharply as strong jobs data reduced expectations for interest-rate cuts. Bitcoin’s technicals weakened, with RSI hitting a three-year low and the price hovering only slightly above a major strategy’s average entry level. Major holders were reported to be selling, including a long-term wallet unloading $1.4 billion in BTC and another entity selling 10,000 ETH to support a share buyback. Institutions faced pressure as well, with concerns that certain digital-asset-related companies could be removed from major indexes, while one prominent mining-related firm carried billions in unrealized losses. Some attributed part of the sell-off to a software glitch. Meanwhile, policy and corporate developments continued: a U.S. representative introduced new crypto legislation, Metaplanet announced plans to purchase $95 million in BTC, Coinbase launched ETH-backed loans through Morpho, and Securitize partnered with Plume to expand real-world-asset offerings. India also signaled plans to launch an ARC stablecoin.

Securitize to Launch Institutional Assets on Plume’s Nest Protocol

Securitize to Launch Institutional Assets on Plume’s Nest ProtocolThe deployment aims to connect tokenized funds with Plume’s RWA investors.

Touareg Group Technologies Co. Launches with USD 1 Billion Capital to Power TrustglobeX — A New Era for Global Crypto Exchange

Touareg Group Technologies Co. Launches with USD 1 Billion Capital to Power TrustglobeX — A New Era for Global Crypto ExchangePRNewswire, PRNewswire, 20th November 2025, Chainwire

Clapp Finance Launches Multi-Collateral Crypto Credit Line: Unlock Instant Liquidity Without Selling Your Crypto

Clapp Finance Launches Multi-Collateral Crypto Credit Line: Unlock Instant Liquidity Without Selling Your CryptoPRNewswire, PRNewswire, 19th November 2025, Chainwire

Paxos Labs and LayerZero Launch USDG0 to Expand Global Dollar Across DeFi

Paxos Labs and LayerZero Launch USDG0 to Expand Global Dollar Across DeFiThe bridged stablecoin will initially roll out on Hyperliquid, followed by Plume and Aptos.

1inch Launches Developer Access to Aqua Liquidity Protocol

1inch Launches Developer Access to Aqua Liquidity ProtocolThe protocol’s front end is expected to be released to the public in Q1 2026.

EV2 Token Presale Launches as Funtico Targets Mainstream Gamers With ‘Earth Version 2’

EV2 Token Presale Launches as Funtico Targets Mainstream Gamers With ‘Earth Version 2’Tortola, BVI, 12th November 2025, Chainwire