NearAI Analysis

Track Near news with AI-powered analysis and real-time market sentiment. Get breaking headlines, price movements, protocol updates, and regulatory developments—all analyzed by our AI for instant insights.

- NEW

Crypto Market Consolidates as Funds Rotate to BTC and ETH After $2B Liquidations: Wintermute

Crypto Market Consolidates as Funds Rotate to BTC and ETH After $2B Liquidations: WintermuteThe crypto market has entered a range-bound consolidation, with Bitcoin near $92,000 and value at $3.25 trillion, as Wintermute research notes resilient majors, muted leverage, and positioning shaped by looming Fed and BOJ policy decisions into year-end. The post Crypto Market Consolidates as Funds Rotate to BTC and ETH After $2B Liquidations: Wintermute appeared first on Cryptonews.

- NEW

Ethereum surges above $3,300 as whales accumulate nearly 1M ETH while retail exits

Ethereum surges above $3,300 as whales accumulate nearly 1M ETH while retail exitsData shows that Ethereum whales have ramped up accumulation recently.

Why The Litecoin Price Could Stage A 33% Rally To $110

Why The Litecoin Price Could Stage A 33% Rally To $110A crypto analyst has forecasted that the Litecoin price is gearing up for an explosive rally to $110. Unlike Bitcoin and Ethereum, which have seen considerable declines over the past few months, Litecoin appears to be stabilizing, gaining about 7.8% this past week, according to CoinMarketCap. Although LTC has seen its fair share of declines this year, analysts still hold hope that the cryptocurrency could cross the $100 threshold and reclaim former highs. Litecoin Price Targets A $110 Breakout Litecoin may be preparing for a strong upward move, according to a new analysis from TradingView market expert MadWhale. The analyst has indicated that the cryptocurrency has the technical structure needed to break out of its long-term descending channel and potentially climb toward $110. With its current price sitting around $83, a surge to this level would represent a significant 33% rally. Related Reading: Litecoin 2M Bollinger Band Width Hits New Lows, CMT-Certified Analyst Reveals What It Means MadWhale has based his bullish LTC forecast on weekly candlesticks and how the cryptocurrency has consistently responded to past support and resistance levels. He explained that the altcoin had been trapped in a descending channel that has controlled its price for several weeks now. According to the TradingView analyst, Litecoin is now approaching the upper resistance region of the descending channel–a point where traders usually watch for either a clean breakout or a sharp rejection. From the analyst’s price chart, Litecoin’s support zones have repeatedly held firm, showing that buyers consistently defended the area. Due to this steady support, he expects Litecoin’s bounce near the descending channel’s upper resistance to build momentum. If the support holds, MadWhale suggests the cryptocurrency could skyrocket to $110, completing its breakout from the descending channel. A breakout could signal a significant shift, potentially transforming Litecoin’s recent downtrend into a new bullish phase. MadWhale’s chart also highlights the cryptocurrency’s volatility, showing that in early October, LTC had rallied around 33.84%, climbing above $120. However, just days later, it crashed more than 17%, coinciding with the October 10 liquidation event that shook the market. Update On LTC’s Price Action Litecoin is approximately 79% below its all-time high of over $410, recorded during the 2021 bull run. The cryptocurrency has dropped 17.68% over the past week and is down 33% for the year, mirroring the broader decline seen across altcoins. Despite its performance, LTC’s Fear and Greed Index remains in the neutral zone, suggesting that crypto investors are cautiously optimistic. Related Reading: Analyst Reveals How Litecoin Can Turn $3,700 Into $1 Million For Investors According to market analyst CW on X, the next sell wall for Litecoin is at $98, about 15% above its current price. Once the cryptocurrency reaches this level, CW expects a significant number of sellers to offload their coins. His chart also highlights the next key resistance levels for LTC, suggesting a potential surge to $98 first and then to the $106-$110 range. Featured image from Adobe Stock, chart from Tradingview.com

What a $440,000 Hack Shows About the Rising Threat of Ethereum 'Permit Scams'

What a $440,000 Hack Shows About the Rising Threat of Ethereum 'Permit Scams'A single mistake cost one user nearly half a million dollars, highlighting how scammers are escalating phishing attacks.

Bitcoin Price Prediction: BlackRock Doubles Down on Crypto with New ETF Filing – Is a Full-Scale Wall Street Invasion About to Begin?

Bitcoin Price Prediction: BlackRock Doubles Down on Crypto with New ETF Filing – Is a Full-Scale Wall Street Invasion About to Begin?BlackRock's SEC filing for a staked Ethereum ETF represents a strategic shift toward yield-bearing crypto products, coming as the firm's Bitcoin ETF commands $70 billion in assets and sovereign funds quietly accumulate BTC despite technical weakness near $92,000. The post Bitcoin Price Prediction: BlackRock Doubles Down on Crypto with New ETF Filing – Is a Full-Scale Wall Street Invasion About to Begin? appeared first on Cryptonews.

Ripple Gets $500 Million From Wall Street, Strategy Makes Biggest Bitcoin (BTC) Purchase in Months, Shiba Inu (SHIB) Eyes Big Price Move – Crypto News Digest

Ripple Gets $500 Million From Wall Street, Strategy Makes Biggest Bitcoin (BTC) Purchase in Months, Shiba Inu (SHIB) Eyes Big Price Move – Crypto News DigestCrypto market today: Wall Street moves $500 million into Ripple; Strategy has purchased nearly $1 billion worth of BTC; 45 billion SHIB leave exchanges.

Wall Street Giant Bernstein Predicts Bitcoin Price To Hit $1 Million By 2033

Wall Street Giant Bernstein Predicts Bitcoin Price To Hit $1 Million By 2033Wall Street research firm Bernstein has reiterated one of the boldest long-term calls in traditional finance, confirming a $1 million Bitcoin price target for 2033 while materially revising how and when it expects the market to get there. Bernstein Keeps $1 Million Price Target For Bitcoin The latest shift surfaced after Matthew Sigel, head of digital assets research at VanEck, shared an excerpt from a new Bernstein note on X. In it, the analysts write: “In view of recent market correction, we believe, the Bitcoin cycle has broken the 4-year pattern (cycle peaking every 4 years) and is now in an elongated bull-cycle with more sticky institutional buying offsetting any retail panic selling.” The analyst from Bernstein added: “Despite a ~30% Bitcoin correction, we have seen less than 5% outflows via ETFs. We are moving our 2026E Bitcoin price target to $150,000, with the cycle potentially peaking in 2027E at $200,000. Our long term 2033E Bitcoin price target remains ~$1,000,000.” Related Reading: Did 2025 Mark A Bear Market For Bitcoin? Predictions Point To A $150,000 Rally In 2026 This marks a clear evolution from Bernstein’s earlier cycle roadmap. In mid-2024, when the firm first laid out the $1 million-by-2033 thesis as part of its initiation on MicroStrategy, it projected a “cycle-high” of around $200,000 by 2025, up from an already-optimistic $150,000 target, explicitly driven by strong US spot ETF inflows and constrained supply. Subsequent commentary reiterated that path and framed Bitcoin firmly within the traditional four-year halving rhythm: ETF demand would supercharge, but not fundamentally alter, the classic post-halving boom-and-bust pattern. Reality forced an adjustment. Bitcoin did break to new highs on the back of ETF demand, validating Bernstein’s structural call that regulated spot products would be a decisive catalyst. However, price action has fallen short of the earlier timing: the market topped out in the mid-$120,000s rather than the $200,000 band originally envisaged for 2025, and a roughly 30% drawdown followed. Related Reading: Bitcoin To Hit $50 Million By 2041, Says EMJ Capital CEO What changed is not the end-state, but the path. Bernstein now argues that the four-year template has been superseded by a longer, ETF-anchored bull cycle. The critical datapoint underpinning this view is behavior in the recent correction: despite a near one-third price decline, spot Bitcoin ETFs have seen only about 5% net outflows, which the firm interprets as evidence of “sticky” institutional capital rather than the reflexive retail capitulation that defined previous tops. In the new framework, earlier targets are effectively rescheduled rather than abandoned. The mid-2020s six-figure region is shifted out by roughly one to two years, with $150,000 now penciled in for 2026 and a potential cycle peak near $200,000 in 2027, while the 2033 $1 million objective is left unchanged. In that sense, Bernstein’s track record is mixed but internally consistent. The firm has been directionally right on the drivers—ETF adoption, institutionalization, and supply absorption—but too aggressive on the speed at which those forces would translate into price. The latest note formalizes that recognition: same destination, slower ascent, and a Bitcoin market that Bernstein now sees as governed less by halvings and more by the behavior of large, ETF-mediated capital pools over the rest of the decade. At press time, BTC traded at $90,319. Featured image created with DALL.E, chart from TradingView.com

Crypto Rally Stalls Near $94K Bitcoin as Bond Turmoil Spurs Risk-Off Ahead of Fed

Crypto Rally Stalls Near $94K Bitcoin as Bond Turmoil Spurs Risk-Off Ahead of FedCrypto has begun December with a rally driven by large Bitcoin purchases and the Fusaka upgrade before fading, as Gracy Chen and Laser Digital point to rising bond yields, expectations for a Fed rate cut, BOJ risks and options pricing that has flagged choppy trading into year-end. The post Crypto Rally Stalls Near $94K Bitcoin as Bond Turmoil Spurs Risk-Off Ahead of Fed appeared first on Cryptonews.

Bitcoin Stalls Near $90K as Select Altcoins Rally, Leaving ‘Altcoin Season’ on Hold

Bitcoin Stalls Near $90K as Select Altcoins Rally, Leaving ‘Altcoin Season’ on HoldAltcoin sentiment has stayed cautious as fear readings sit near 25 and Bitcoin has traded just above $90,000, while Zcash, MemeCore and Cardano have posted modest gains that reflect selective interest rather than a broad return of risk appetite. The post Bitcoin Stalls Near $90K as Select Altcoins Rally, Leaving ‘Altcoin Season’ on Hold appeared first on Cryptonews.

Avalanche nears $1T volume – Will AVAX’s KEY support zone hold?

Avalanche nears $1T volume – Will AVAX’s KEY support zone hold?AVAX strengthened after breaking its wedge as usage and volume climbed, signaling utility-driven momentum.

Bitcoin edges near ETF average cost as inflows slow and price consolidates

Bitcoin edges near ETF average cost as inflows slow and price consolidatesBitcoin is trading close to the average entry price of U.S. spot ETFs, while daily inflows temporarily turn negative.

Bitcoin Treasury Company Twenty One Drops 25% in NYSE Debut, Trades Near PIPE Pricing of $10

Bitcoin Treasury Company Twenty One Drops 25% in NYSE Debut, Trades Near PIPE Pricing of $10The company is led by Strike CEO Jack Mallers and began trading under the XXI ticker today following its SPAC merger with Cantor Equity Partners.

Old Ethereum Whale Moves $1.19 Billion After A Decade—Here’s Why It’s A Big Deal

Old Ethereum Whale Moves $1.19 Billion After A Decade—Here’s Why It’s A Big DealThe reappearance of this early-era wallet after nearly ten years has amplified speculation that sophisticated capital could flow into Ethereum in the coming months.

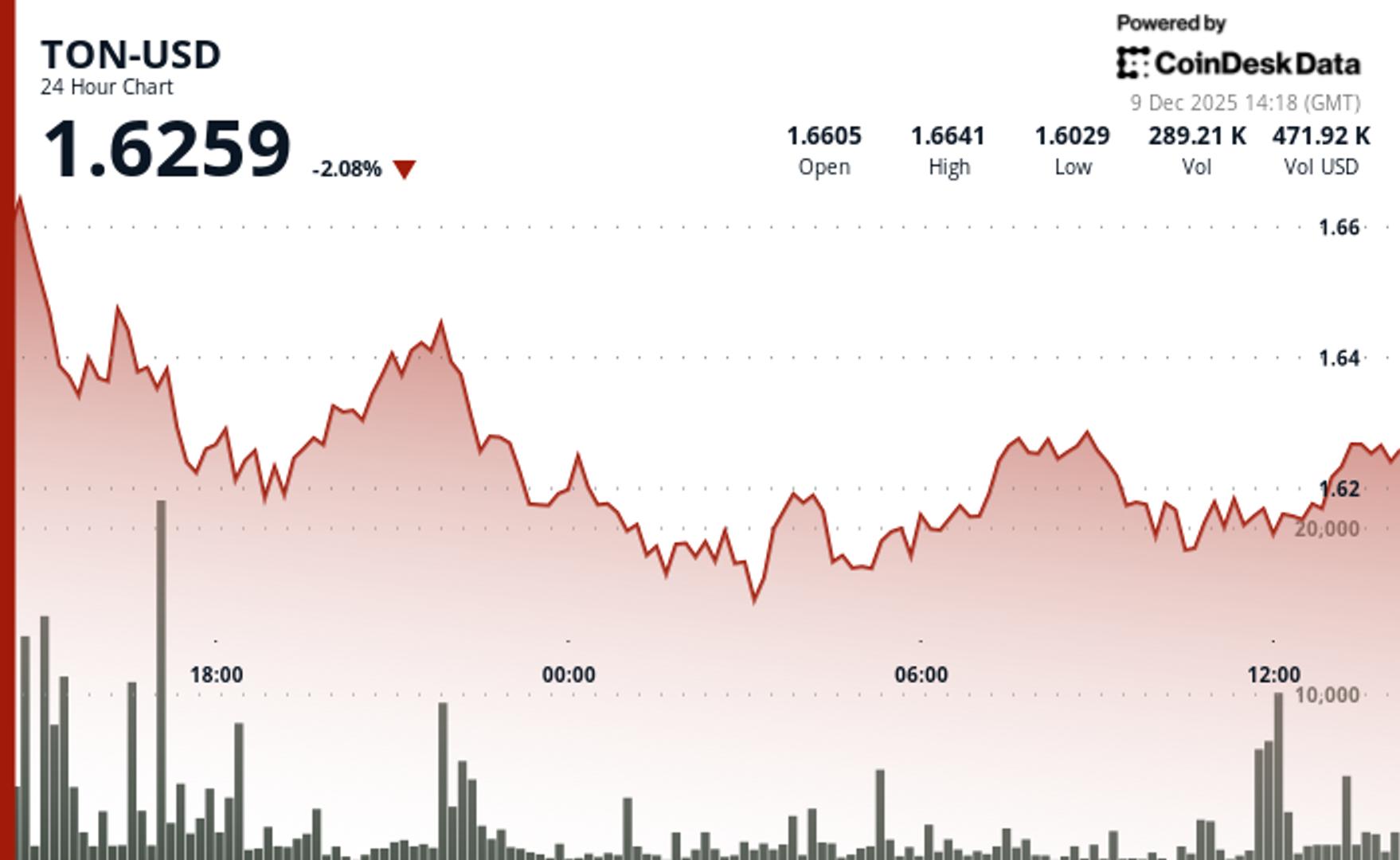

TON Token Yearly Loss Nears 72%, but Potential Reversal Signs Emerge

TON Token Yearly Loss Nears 72%, but Potential Reversal Signs EmergeThe token's price found support at $1.6025, which held firm despite initial selling pressure, and has since shown signs of a potential reversal.

XRP Secures $1B AUM Milestone, Sets ETF Speed Record In The US

XRP Secures $1B AUM Milestone, Sets ETF Speed Record In The USXRP Spot ETFs have nearly crossed the $1 billion mark in assets under management (AUM), marking one of the quickest ramps since Ethereum, according to Ripple’s CEO. Related Reading: All-In On XRP: Why This Leading Investor Sold His Entire Bitcoin Stack Rapid Fund Growth In Weeks According to the disclosure, the four XRP ETF products now hold about $1.23B in total net assets, which equals 597 million XRP at a reported XRP price of $2.06. Reports have disclosed a fresh inflow of $30 million on Monday, Dec. 8, and the cumulative net inflow into these products stands close to $935 million. Ripple CEO Brad Garlinghouse highlighted that the collective figure reached the $1 billion level in under four weeks after the first fund hit the market. Canary Capital Leads With Heavy Flows Canary Capital’s XRPC grabbed the most attention at launch, bringing roughly $245 million in net flows on its debut day on Nov. 13. Canary’s fund holds about 335.889 million XRP, valued at approximately $691 million, which represents 56% of the combined assets across the four funds. 👀<4 weeks, and XRP is now the fastest crypto Spot ETF to reach $1B in AUM (since ETH) in the US. With over 40 crypto ETFs launched this year in the US alone, a few points are obvious to me: 1/ there’s pent up demand for regulated crypto products, and with Vanguard opening up… — Brad Garlinghouse (@bgarlinghouse) December 8, 2025 The other managers hold smaller shares: Grayscale’s product holds 104.381 million XRP, about $215 million or 17.47% of the total; Bitwise carries 93.827 million XRP valued at $193.284 million or 15.7%; Franklin Templeton has 62.99 million XRP worth about $131.829 million, or 10.71%. A Wave Of Approved Crypto Funds Based on reports, this development follows a broader rollout of spot and futures crypto ETFs since US spot Bitcoin ETFs arrived in January 2024. Ethereum spot products launched in July 2024, and Solana listings came in October 2025. The US Securities and Exchange Commission has approved more than 40 crypto-related ETF products this year, which market participants say has opened familiar rails for mainstream investors. Vanguard’s choice to allow crypto access inside standard retirement and broker accounts is being cited as a change that lets many Americans gain exposure without deep crypto know-how. What This Means For Investors According to analysts and market observers, the speed of these flows underlines strong demand for regulated crypto vehicles. Big-name asset managers entering the market have helped create options that look and act like other mutual funds or ETFs, which can ease the path for retirement plans and advisers to take part. At the same time, a large share resting in a single debut fund shows concentration risk: Canary’s XRPC accounts for more than half of the total net assets, and that matters for liquidity and fund dynamics if flows shift. Related Reading: Banking Meets Bitcoin: French Banking Giant Offers Crypto To Millions Fresh Inflows & ETF Demand While $1.23 billion is a headline figure, market watchers will be watching fresh inflows, trading volumes, and how price moves react to ETF demand. For now, XRP listings have drawn sizable attention, and the coming weeks should make clearer whether the early momentum will spread more evenly across products and push broader investor participation. Featured image from Unsplash, chart from TradingView

PEPE Price Prediction: Target $0.0000065 by January 2026 as Meme Coin Eyes 45% Rally

PEPE Price Prediction: Target $0.0000065 by January 2026 as Meme Coin Eyes 45% RallyPEPE price prediction suggests consolidation near $0.000004096 before potential breakout to $0.0000065. Technical analysis shows neutral RSI with emerging bullish momentum signals. (Read More)

ALGO Price Prediction: Targeting $0.16-$0.19 Recovery Within 2-4 Weeks as Technical Indicators Signal Oversold Bounce

ALGO Price Prediction: Targeting $0.16-$0.19 Recovery Within 2-4 Weeks as Technical Indicators Signal Oversold BounceALGO price prediction shows potential 23-46% upside to $0.16-$0.19 targets as oversold RSI and bullish MACD divergence suggest near-term recovery from current $0.13 support. (Read More)

INJ Price Prediction: Target $6.20 by Year-End 2025 Despite Near-Term Volatility

INJ Price Prediction: Target $6.20 by Year-End 2025 Despite Near-Term VolatilityINJ price prediction targets $6.20 resistance break within 3 weeks, with Injective forecast showing neutral momentum as MACD turns bullish despite RSI consolidation. (Read More)

DeFi TVL climbs back toward $140b as Hyperliquid and rivals dominate

DeFi TVL climbs back toward $140b as Hyperliquid and rivals dominateDeFi TVL rebounds near $140b as perp DEXs, spot volumes, and stablecoin flows jump, but hacks and regulation keep sentiment fragile. DeFi is expanding again. TVL is rising. Volatility stays high. The sector still lags the broader crypto market, but…

CRV Price Prediction: Targeting $0.55-$0.76 Medium-Term Despite Near-Term Headwinds

CRV Price Prediction: Targeting $0.55-$0.76 Medium-Term Despite Near-Term HeadwindsCRV price prediction shows mixed signals with bearish near-term pressure but bullish medium-term targets of $0.55-$0.76 as MACD momentum turns positive. (Read More)

Crypto nears its ‘Netscape moment’ as industry approaches inflection point

Crypto nears its ‘Netscape moment’ as industry approaches inflection pointCrypto is at a mainstream tipping point due to the emergence of regulated investment products, according to Matt Huang of Paradigm.

NEAR Price Prediction: $2.10 Target by December 2025 as Protocol Tests Key Resistance

NEAR Price Prediction: $2.10 Target by December 2025 as Protocol Tests Key ResistanceNEAR price prediction targets $2.10 by December 2025, representing 20% upside. Technical analysis shows neutral RSI and emerging bullish momentum signals. (Read More)

UNI Price Prediction: $6.50 Target by Year-End 2025 as Uniswap Tests Critical Support

UNI Price Prediction: $6.50 Target by Year-End 2025 as Uniswap Tests Critical SupportUNI price prediction suggests a potential 18% rally to $6.50 by December 31st, 2025, as technical indicators show oversold conditions near the $5.37 support level. (Read More)

DOT Price Prediction: Targeting $2.75-$3.30 Recovery Rally Within 4-6 Weeks

DOT Price Prediction: Targeting $2.75-$3.30 Recovery Rally Within 4-6 WeeksDOT price prediction suggests potential 31-57% upside to $2.75-$3.30 range as oversold conditions and bullish MACD divergence signal medium-term recovery despite near-term weakness. (Read More)

Shiba Inu price whales load up as price hovers 90% below peak near key $0.0000095 wall

Shiba Inu price whales load up as price hovers 90% below peak near key $0.0000095 wallShiba Inu (SHIB) price is currently trading near 0.0000085. The market is currently sitting between boredom and ambush. Shiba Inu Price map Shiba Inu price (SHIB) is currently trading inside roughly 0.0000075 to 0.0000095.0.0000075 is currently acting as first support.…

Binance confirmed a rogue employee used the company account to pump a personal token 4,600% in minutes

Binance confirmed a rogue employee used the company account to pump a personal token 4,600% in minutesOn Dec. 7, at 05:29 UTC, someone deployed a token called “year of yellow fruit” on-chain. Less than one minute later, the Binance Futures official account posted text and images promoting the token. Within two hours, the token surged 4,600% and reached nearly $4 million in market cap. Binance’s internal audit confirmed an employee used […] The post Binance confirmed a rogue employee used the company account to pump a personal token 4,600% in minutes appeared first on CryptoSlate.

Cardano price eyes $0.50 but $0.38 support still at risk

Cardano price eyes $0.50 but $0.38 support still at riskCardano’s ADA price is currently trading near $0.43 on Binance, sitting just under short‑term resistance around $0.45 while intraday support clusters near $0.42–$0.40. The structure favors a choppy, leveraged range with a slight downside skew into late December unless bulls…

Binance Records Sudden 50,000,000 ADA Transfer, Cardano Price Reaction Unveiled

Binance Records Sudden 50,000,000 ADA Transfer, Cardano Price Reaction UnveiledA 50,000,000 ADA jump worth $21.4 million hit Binance from an unknown wallet, landing right as Cardano trades near yearly lows and forcing everyone to watch what this whale plans next.

Dogecoin price eyes rebound toward $0.16 if $0.14 floor continues to hold

Dogecoin price eyes rebound toward $0.16 if $0.14 floor continues to holdDogecoin (DOGE) price is currently trading near 0.14 USDT on Binance. Price is sitting in the lower half of its 2025 range and stays locked inside a clean bearish channel that started after rejection around 0.21. Dogecoin price levels, structure,…

Solana bulls fight to defend $130 as ETF demand meets unlock selling

Solana bulls fight to defend $130 as ETF demand meets unlock sellingSolana clings to $130 support as ETF demand and roadmap upgrades clash with legacy selling pressure. Solana trades near $133 at a critical support area, where strong ETF inflows and structural upgrades face off against lingering unlock-driven supply and a…

Can TAO’s upcoming halving event unlock Bittensor’s next big breakout?

Can TAO’s upcoming halving event unlock Bittensor’s next big breakout?As TAO's halving event draws near, traders wait with bated breath.

Zcash price tests symmetrical triangle resistance near $420 — is a secondary breakout coming?

Zcash price tests symmetrical triangle resistance near $420 — is a secondary breakout coming?Zcash price is testing the $420 resistance of a multi-month symmetrical triangle as rising trading volume and institutional accumulation hint at a potential breakout. Zcash was trading at $395 at press time, up 11% over the past 24 hours, as…

Strategy’s Stockpile Swells To 660,624 BTC After Scooping Up Nearly $1B In Bitcoin Last Week

Strategy’s Stockpile Swells To 660,624 BTC After Scooping Up Nearly $1B In Bitcoin Last WeekStrategy added 10,624 Bitcoin between Dec.1 and Dec. 7 for $962.7 million— its largest purchase since July.

Tom Lee’s BitMine Buys $429 Million in Ethereum as ETH Rebounds

Tom Lee’s BitMine Buys $429 Million in Ethereum as ETH ReboundsEthereum is up nearly 11% on the week, and top ETH treasury firm BitMine is still adding to its $12 billion stash.

Strategy Drops Nearly $1 Billion on Bitcoin, Marking Largest BTC Buy in Months

Strategy Drops Nearly $1 Billion on Bitcoin, Marking Largest BTC Buy in MonthsStrategy unveiled its largest Bitcoin purchase in over 100 days, but the company's stock price was little changed on Monday.

BREAKING: Strategy Announces Biggest Bitcoin Purchase in Months

BREAKING: Strategy Announces Biggest Bitcoin Purchase in MonthsStrategy has purchased nearly $1 billion worth of Bitcoin.

Ripple Price Analysis: XRP Plotting a Move to $2.5 as Sellers Get Tired

Ripple Price Analysis: XRP Plotting a Move to $2.5 as Sellers Get TiredXRP continues to hover near critical support zones as overall market sentiment remains cautious. While Bitcoin dominance puts pressure on altcoins, XRP’s recent structure shows a mix of compression and potential exhaustion in the sell-off. Both the USDT and BTC pairs are at decision points, with price action tightening and RSI levels trending below the […]

Bitcoin price stalls below key $100k–$120k resistance band

Bitcoin price stalls below key $100k–$120k resistance bandBitcoin (BTC) traded little changed around 91,500–92,000 dollars on Monday, with spot prices hovering near the upper end of their recent range and keeping the network’s market value close to 1.8 trillion dollars. The move left the asset consolidating near…

- Crypto News Today: ETH Holds Firm Above $3k As It Heads Into December- What’s Next?

The crypto space is beginning to turn. Bitcoin (BTC) is the preferred crypto flavour of the month since it has bounced back from the lows of $88,000 to above $91,000, gobbling up liquidity across the board, highlighting how tricky weekends can be. However, there is another key player that is not getting nearly as much.. The post Crypto News Today: ETH Holds Firm Above $3k As It Heads Into December- What’s Next? appeared first on 99Bitcoins.

510,000,000 XRP Dumped by Whales Last Week: Good or Bad News for Ripple Prices?

510,000,000 XRP Dumped by Whales Last Week: Good or Bad News for Ripple Prices?Whales sold 510M XRP last week as price nears triangle breakout. Analysts watch $2.27 resistance and $1.99 support for next move.

Cardano Founder Promises 'Good Day' on Monday, ADA Community on Alert

Cardano Founder Promises 'Good Day' on Monday, ADA Community on AlertHoskinson's hint that Monday "will be a good day" put ADA holders on alert, with the token stuck near local lows and last December's 277% rebound still shaping expectations.

XRP Burn Metric Headed to Zero, Is Rally Over?

XRP Burn Metric Headed to Zero, Is Rally Over?XRP has declined by nearly 60% in its burn metric amid the unexpected price reversal that has seen the price record notable daily declines.

Crypto Markets Continue to Climb as Bitcoin Reclaims $93,000

Crypto Markets Continue to Climb as Bitcoin Reclaims $93,000Nearly all top-20 tokens by market cap are in the green as the market continues its recovery.

Hyperliquid Catches Flak for Reassigning MON Ticker

Hyperliquid Catches Flak for Reassigning MON TickerPixelmon purchased the MON ticker on Hyperliquid for nearly $500,000 earlier this year; however, MON on Hyperliquid now points to Monad.

Level Up with #7Up: Bybit’s 7th Anniversary Shares a $2.5 Million Thank-You with Nearly 80 Million Traders Worldwide

Level Up with #7Up: Bybit’s 7th Anniversary Shares a $2.5 Million Thank-You with Nearly 80 Million Traders WorldwidePRNewswire, PRNewswire, 26th November 2025, Chainwire

Monad Launches Mainnet, MON Trades Near ICO Price

Monad Launches Mainnet, MON Trades Near ICO PriceMON briefly surged 14% higher than its ICO price after listing across major CEXs, before retracing.

NFT Lending TVL Nears All-Time Lows

NFT Lending TVL Nears All-Time LowsOutstanding debt has fallen by around 45% to $80 million from $150 million in March 2024.

Nearly 20% of Americans Would Prefer Crypto Over Gift Cards This Holiday Season: PayPal

Nearly 20% of Americans Would Prefer Crypto Over Gift Cards This Holiday Season: PayPalA new survey finds that younger adults are leading crypto adoption for gifting and shopping.